This is a guest blog post by Jens Wessel of IT company Zendri.

Dealing with finance and billing issues is the last thing you want to deal with in your day-to-day work. Invoicing your advertisers and publishers can be a lengthy and time-consuming effort, but it doesn’t have to be.

The good news: it’s getting much easier. Managing bill conversions the right way in combination with tools helping you to stay on top of your cash-flow, are key for a flawless and easy billing process.

Why bill conversions matter

Bill conversions are all conversions relevant for billing. Confirmed conversions can be reviewed within the conversion report section of the HasOffers dashboard. They will appear on invoices for both (advertisers and publishers) as long as they have been approved.

To make sure that fraudulent conversions are kept out of payments, it is of high importance to adjust conversions if needed. There are two ways of adjusting conversions:

- Approve after leaving them on a pending status. They turn into bill conversions once the advertiser has finished the investigation of the conversion’s validity and confirms them as approved.

- Auto-approve by the system. This is a more publisher-friendly way as they see conversions as soon as they are generated within their reports. The auto-approval will require an investigation by the advertiser after the approval of the conversions. This might require to reject a conversion in case it could not be classified as a valid one.

For young timeframes (that is, timeframes that have just ended), it is important to adjust conversions as quick as possible once the validity has been clarified. Usually, you should make sure to regularly monitor bill conversion adjustments for the previous three months. Most changes regarding investigations about bill conversions happen by manually checking the previous month’s conversions.The quicker you create an invoice for a specific timeframe, the more adjustments will have to be reflected on future invoices for the same timeframe.

What happens if a network does not adjust bill conversions? Depending on the type of offers a network is dealing with, it can be more or less necessary to adjust bill conversions. If there is no grace period for leads on an offer, there is no bigger need for that. But in most cases, advertisers will have to investigate about the validity of a conversion. This requires adjustment of bill conversions on the network’s side as well.

In case bill conversions are not adjusted when they should be, it might lead to higher manual effort to invoice correct amounts. Once adjustments are reported on the advertiser side, networks will have to delete and manually re-generate invoices. By adjusting bill conversions within HasOffers, the network makes sure to have a clean reporting and a flawless invoicing at the same time.

Keep track of conversion adjustments

For networks, it can be a daily routine to change conversions in status or value. In HasOffers, it is easy to switch a conversion from pending to approved, approved to rejected, bulk update or upload conversions. If you did not invoice the advertiser or publisher concerned so far, there should be no problem.

Here’s how to approach it if you already invoiced the advertiser or publisher. The old method: Finance deletes the invoice, updates the amount billed or paid, and recreates the document. Thankfully, that is no longer an issue.

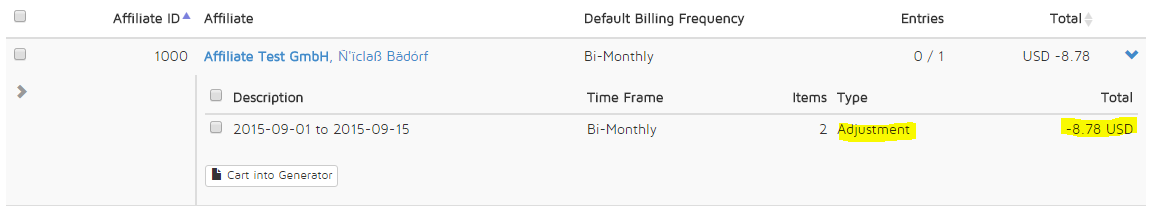

The new method: Billoid tracks all of the changes before and after clients have been invoiced automatically. This is an optimized way to process your HasOffers data. Once you’ve identified changes, you are provided with transparent adjustments for the respective timeframe. These adjustments can be added to the next invoice stating the offer, timeframe, conversions, and payout or revenue.

Pay covered payouts only

Working as a network or an agency means you have to coordinate advertiser and publisher payments at the same time. It is essential to make sure that publisher payments will not cause trouble when the advertiser side has not yet paid. Many finance people from affiliate networks confirmed that it can be very time consuming if you try to stay fully hands-on to track the coverage of publisher payments manually.

So, how can you stay on top of your cashflow? We added some exciting functionality to our product Billoid called Cash Flow Management aimed at this concrete issue. That means networks using our service have the opportunity to decide whether they want to pay a publisher only for offers “covered” by advertiser payments or also pay the “not covered” offers.

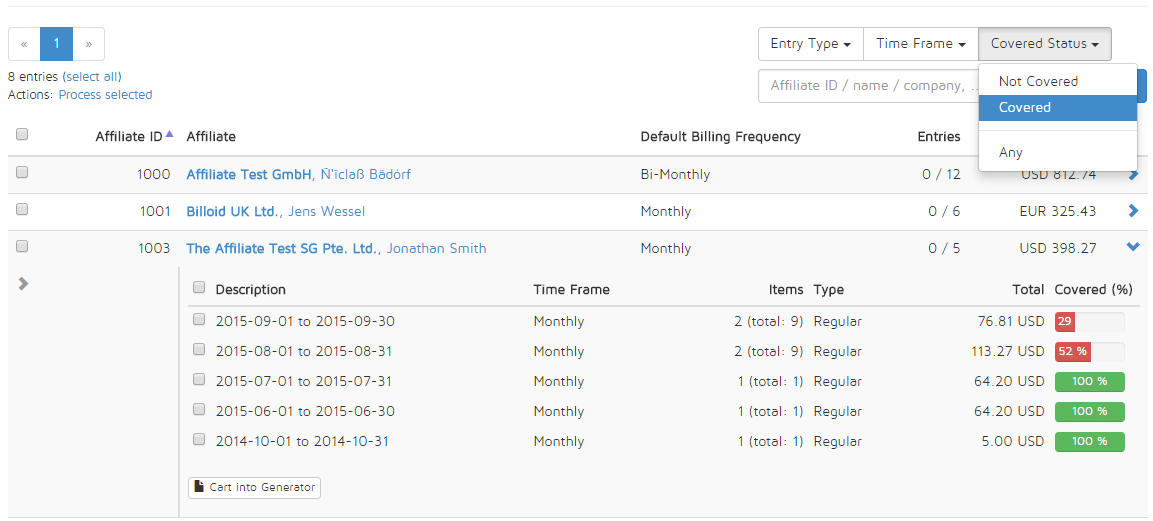

Filter by covered status

You can filter by covered status before creating the credit notes (affiliate invoices) for publishers. The filter includes the covered status options “not covered” and “covered.” Once an advertiser invoice got marked as paid, the related publisher revenues will automatically turn ”covered” so that they can be filtered for payment. After you apply the filter, you will see the open amount that is covered by advertiser invoices. If you invoice these items (offers), all “not covered” items for the same time period will remain in the table as unbilled while the “covered” items will be in the credit note document.

To know how many items are not covered and will not be billed through the filter, you can see the number of items in total that exist for the time range.

Define your covered status

While the “covered” classification for publisher revenue means a fully paid related advertiser invoice on the other side, you are able to change this definition in the settings. You can define what percent of an advertiser invoice has to be paid to classify related publisher revenues as ”covered.”

Documentation

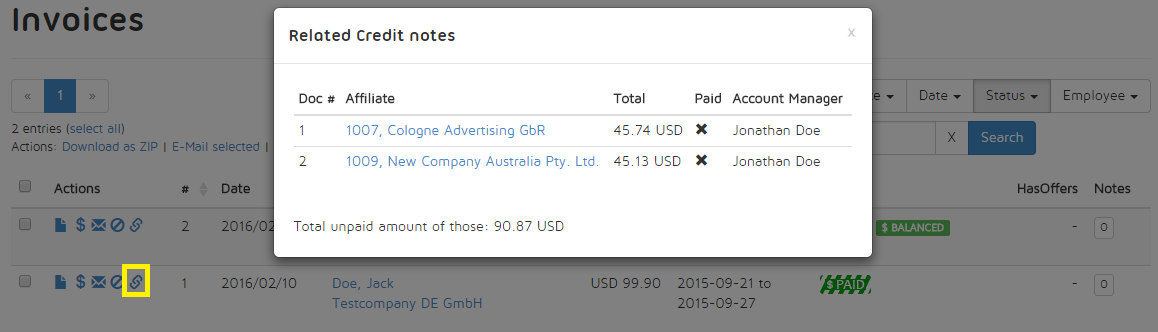

Once you have created advertiser invoices and publisher credit notes, they show up in the invoice and the credit note lists. For every document, you can see the related documents, including whether they have already paid and who is the responsible account manager.

Final thoughts

The billing process for networks can take a lot of time and can be labor-intensive. But if you are able to adopt the pace of many parts of your business and line up with the right tools for billing and finance issues, you can have a flawless and hassle-free billing process.

Make sure to have a clear process of managing bill conversions during their billing cycles to minimize bill conversion adjustments on future periods. Also, by paying publishers for payouts only that have already been received from their advertisers, you can reduce cash-flow risks.

Like this article? Sign up for our blog digest emails.

Author

Becky is the Senior Content Marketing Manager at TUNE. Before TUNE, she handled content strategy and marketing communications at several tech startups in the Bay Area. Becky received her bachelor's degree in English from Wake Forest University. After a decade in San Francisco and Seattle, she has returned home to Charleston, SC, where you can find her strolling through Hampton Park with her pup and enjoying the simple things in life.

Leave a Reply

You must be logged in to post a comment.