Buy vs. DIY: Considerations for Scaling Your Ad Network

2019 Update: HasOffers has rebranded to TUNE! Read the rebrand announcement or head to our homepage to learn more.

The question of whether to buy a performance marketing platform or develop core capabilities in-house is central to every ad network. For network owners and CTOs, it’s a decision with direct impact on short and long-term business growth. This e-book will illustrate how successful ad networks are navigating a range of cost, resourcing, and risk management factors to make informed infrastructure decisions. It is applicable to those just getting started, as well as companies seeking to migrate their existing tracking technology to a new platform.

Since HasOffers entered the performance marketing industry in 2009, we’ve heard dozens of reasons for and against developing a tracking platform in-house. Those who develop in-house often mention control and feature prioritization among their driving influences. While both are important, we’ve also noted an abundance of negative repercussions for ad networks that take the “develop it yourself” approach. In the sections that follow, we’ll highlight the pros and cons of Buy vs. DIY and how you can make the best decision for your business.

Getting Started with Performance Tracking Platform Infrastructure

Before diving into the opportunity costs of Buy vs. DIY, it’s worth reviewing the top benefits all tracking platforms should deliver:

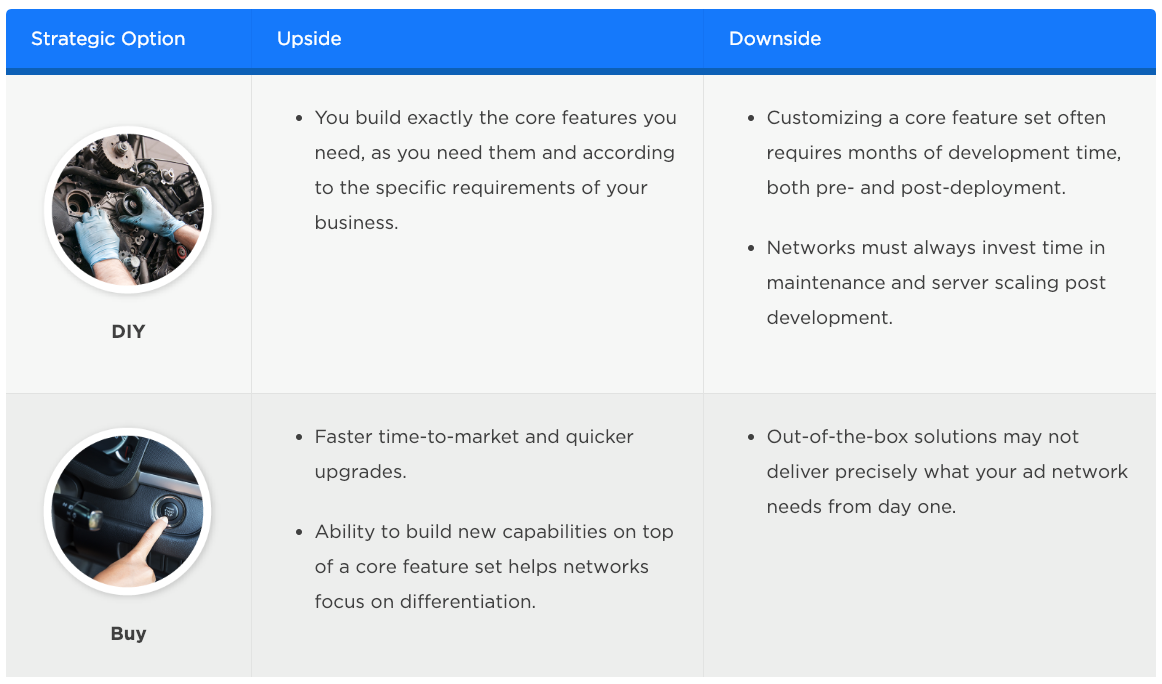

How Time & Resource Tradeoffs Influence Buy vs. DIY

Development time is one of the largest tradeoffs ad networks face when comparing Buy vs. DIY. For example, developing core tracking, reporting, and payment platform functionality often requires at least six months of full-time focus for 2–3 engineers and an additional 75% of their time post-deployment for daily maintenance. Barring the need for exceptionally unique capabilities and massive network volume, these are investments that seldom pay off. Another important factor is the time required to bring a new platform to market and help users familiarize themselves with key functions. As above, to those for whom the need for customization supersedes time-to-market, developing in-house (DIY) provides the freedom to own 100% of the desired product feature set. Alternatively, for networks focused on generating revenue as fast as possible, a leading third-party tracking solution should be expected to accelerate time-to-market and be both flexible and easy to learn. Here’s a summary of the biggest time-influenced upsides and downsides of Buy vs. DIY:

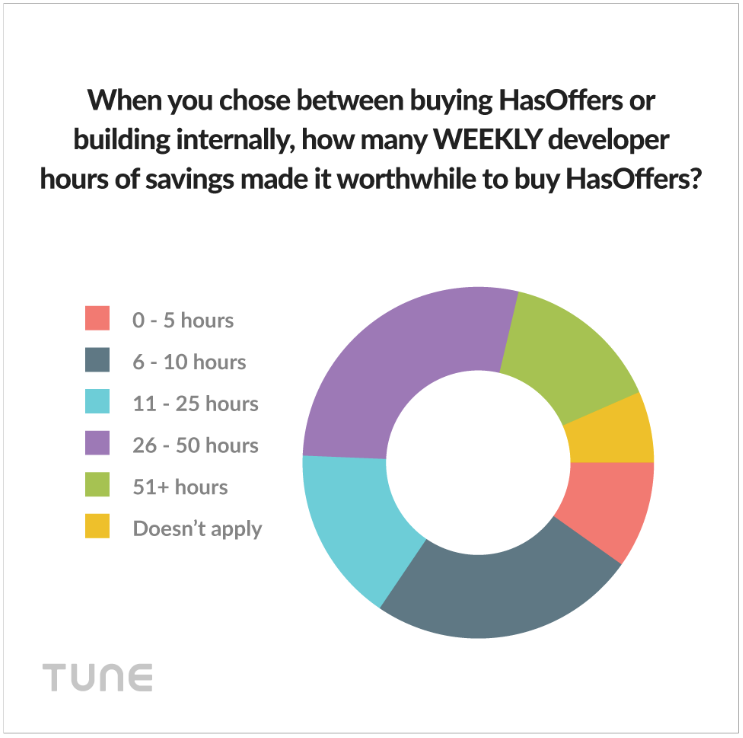

To learn more about how ad network managers benefit from buying the HasOffers platform rather than developing an in-house solution, we asked 70 customers which core capabilities save them the most time and money. Their responses were as follows:

- Conversion tracking (97%)

- Creating and using custom tracking links (86%)

- Customizable reporting (51%)

- Publisher management (46%)

- Affiliate interface (46%)

Combining survey data with direct quotes reinforces the time and money benefits of buying rather than developing the foundational tracking technology ad network owners need:

For us, we knew the mom/family/baby space really well and had an idea of how to succeed in the market. Our goal was to create a publisher-facing platform that would allow content publishers and bloggers in those segments to seamlessly partner with the brands they want, when they want, without having to log in and out of 7+ affiliate networks. While we knew there was a void in the market for this type of platform, we weren’t sure exactly how the idea was going to work in practice. Rather than spend years on R&D with a fully custom platform, we decided to invest in a hybrid model using custom development paired with HasOffers tools. By partnering with HasOffers for our tracking, we were able to get our product to market in 6 months rather than 2+ years.

- Lindsay Hittman, President, BrandCycle

When we launched our platform, our goal was not to spend time rebuilding functionality that has already been developed or commoditized. We wanted to focus our R&D efforts on unique features. The HasOffers platform allowed us spend our efforts building on top of the APIs, using the functionality that had been developed for the key features that we needed but were not the differentiating factors in our business model.

- Tim Koschella, Founder and CEO, AppLift

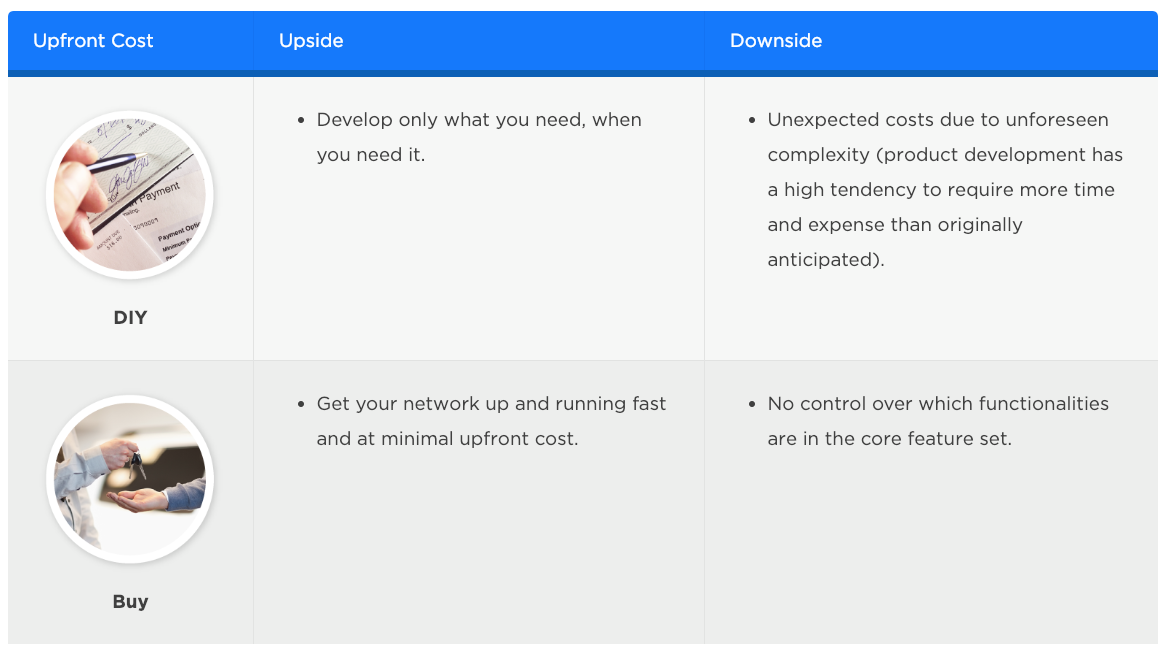

Upfront Costs

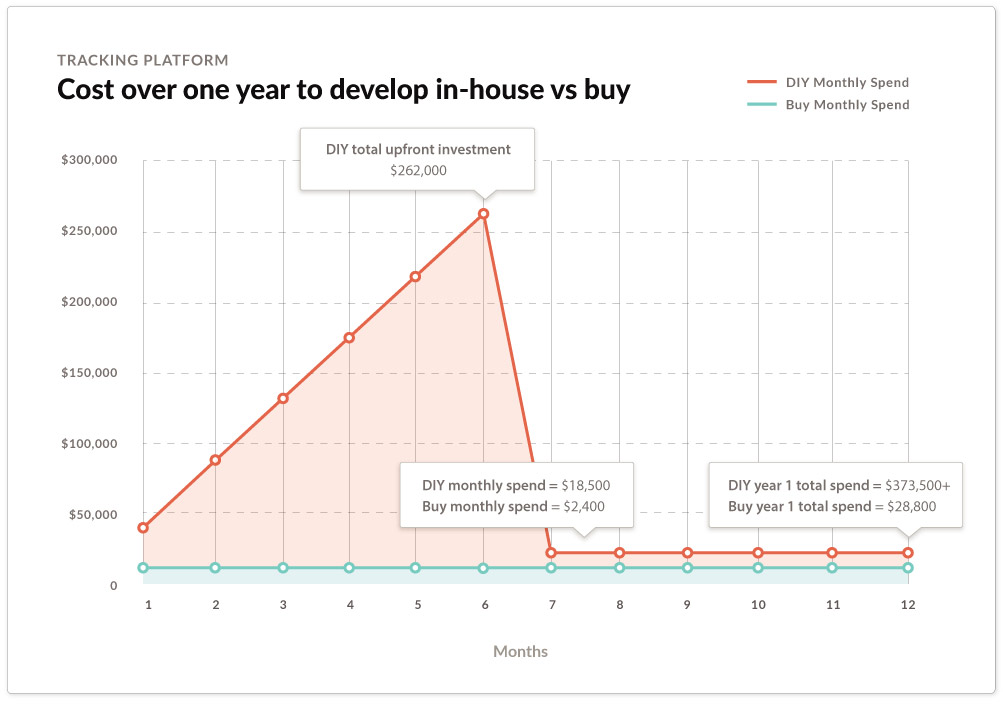

For many ad networks, upfront costs tend to be higher when developing core functionality themselves rather than buying an out-of-the-box solution. From developer salaries and signing bonuses to tech, office space, servers, domains, SSL certificates and more, the costs can be prohibitively detrimental to ROI.

Upfront Cost Drivers

As illustrated in the bullet points below and the interactive graphic later in this e-book, cost drivers vary widely for Buy vs. DIY and depend in large part upon the following key variables*:

- Server uptime/downtime: Infrastructure investment needs directly relate to server uptime commitments, a dynamic that networks dedicated to best-in-class service levels must take into account. For example, in a DIY scenario an ad network’s upfront server costs can be 67% higher to deliver 99.999% versus 99.9% uptime. In a Buy scenario, these costs are included in monthly service charges.

- Number of countries: The more countries and regions in which a network’s publishers are running, the more servers are needed. This additional complexity can add up to 27% in incremental setup costs for a network pursuing a DIY strategy and running in 15 markets versus 1-5 markets. Alternatively, for those electing to Buy, these fees are also accounted for in upfront setup charges.

- Engineering: For a typical ad network, three full-time engineers are typically required to devote six months to developing automated tracking capabilities. Depending upon the market for engineering talent, this upfront investment can range from $120,000 to over $150,000 USD. Networks choosing to Buy rather than DIY can take advantage of ready-to-go technology available at a fraction of the setup cost.

(*Note: Estimates are based upon HasOffers data and experience.)

For our business goals, we realized that building a fully in-house platform would be more costly than partnering with other companies that have already built similar tools and products that solve pieces of our problems. As a bootstrapped, cost-conscious, and profit-focused company, HasOffers allowed us to bypass a lot of our startup costs.

- Lindsay Hittman, President, Brand Cycle

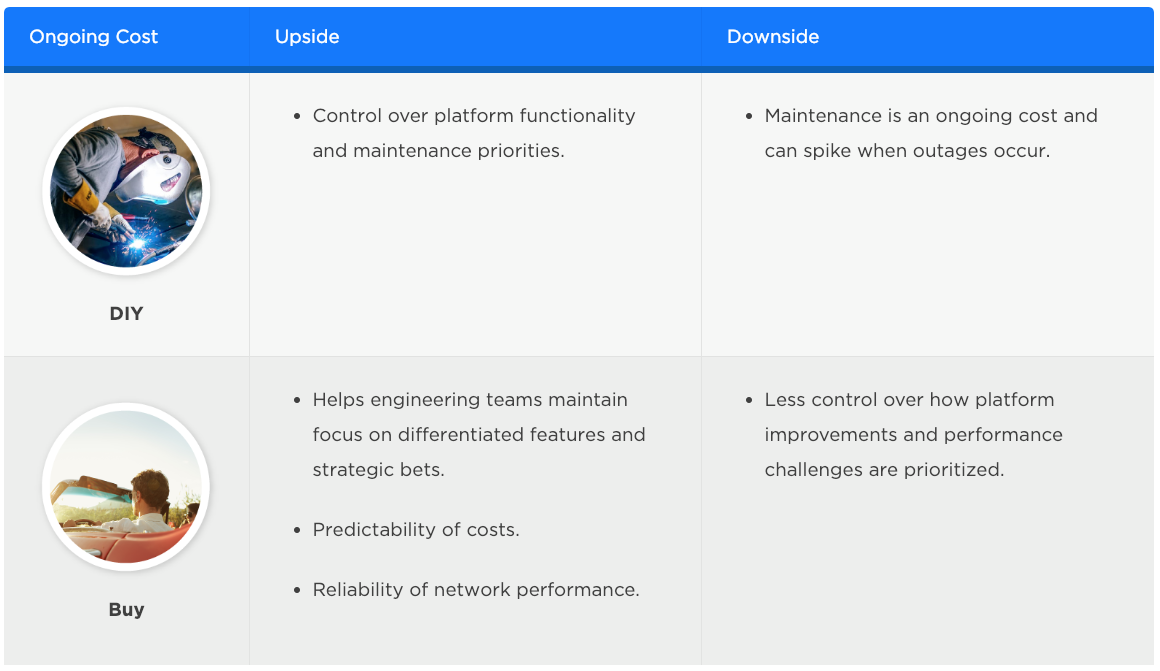

Ongoing Costs

Ad network owners realize that platform maintenance and related ongoing costs can be a profit-crushing nemesis. Given how important it is to effectively utilize and manage engineers, ongoing costs can also have a negative impact on strategic investments. In our experience, too many network owners and CTOs underestimate the risk and expense of recovering tracking data when servers go down, daily server scaling, data archiving and retention, and other variable costs that can spike at the least opportune moments. Here’s a snapshot of how we frame the upside and downside of Buy vs. DIY with respect to ongoing costs:

Ongoing Cost Drivers

Many network owners frame their ongoing costs by taking into account the following variables*:

- Server uptime/downtime: Service level agreements (SLAs) have a direct influence on ongoing costs, which can spike for DIY networks during platform outages. Again, the difference between 99.9% and 99.999% uptime can be significant, in many instances increasing maintenance costs by 50%. Couple these costs with the time required to monitor SLAs and DIY networks often experience lower margins than if they chose to Buy the same capabilities from a third party.

- Number of countries: Maintenance needs increase with the number of countries served by an ad network. Similar to related upfront costs, ongoing maintenance can add over 25% in incremental charges for a network with a DIY strategy and running in 15 markets versus 1-5 markets. While Buy costs also rise with additional market coverage, the increases are often more predictable than in the DIY case.

- Engineering: Ad network support costs for DIY scenarios also increase as a function of uptime and click volume, and can range from approximately 120 monthly hours for a network generating 1-5 million monthly clicks on 99.9% uptime in 1 country to 432 monthly hours for a network generating 25-100 million monthly clicks on 99.999% uptime in 5-10 countries. As highlighted elsewhere, Buy options help keep scaling costs such as these more predictable and lower than they might otherwise be.

- Industry vertical: It’s critical for ad network leaders to take into account the relationship between industry verticals and data volumes. Verticals with a high conversion rate and low cost/lead tend to generate high volumes of data, which can make it costly for networks to process conversion events. For example, total ongoing DIY costs can vary by as much as 75% based on industry vertical. While variability also exists for those operating in the Buy scenario, accommodating industry-related data volumes is more seamless (and far less stressful).

(*Note: Estimates are based upon HasOffers data and experience.)

How Much Does One Year of Developing an In-house Network Cost?

HasOffers allows us to quickly add new retail partners to our platform without it being a heavy task for our development team. This time savings allows our development team to spend more time on our publisher tools and front-end platform rather than on tracking and retailer integrations.

- Lindsay Hittman, President, BrandCycle

At the core, HasOffers allows us to outsource our engineering and IT departments. As a marketing firm that’s growing quickly, to know we can count on a third party tracking platform like HasOffers to be efficient, available, and always up and online is a relief. We don’t have to worry about server downtime and other maintenance issues. With the HasOffers team taking care of the platform maintenance, we can focus on growing our business.

- Brian Fox, CEO, AdAction Interactive

For more on how to use HasOffers to build differentiating technology, one of our solutions engineers recently shared “How to Use the HasOffers API for Your Secret Sauce” as a starting point.

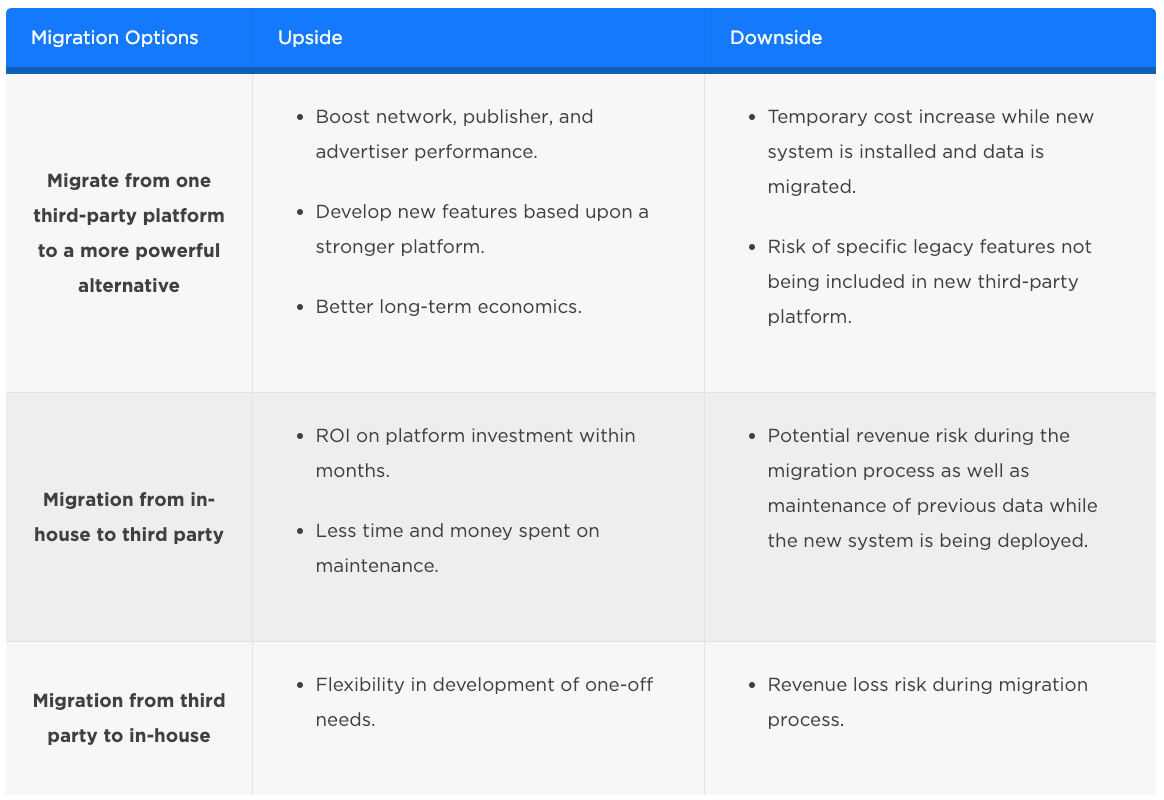

Migrating to a New Performance Marketing Tracking Platform

Network owners and CTOs typically consider migrating from one platform to another when they outgrow their current platform’s capabilities or when new functionality becomes available elsewhere. Because switching can result in lost time, it’s critical that the upside advantages and downside costs of migration are thoroughly analyzed in advance. Here’s a snapshot of key migration options and the potential impact of each:

Migration Cost Drivers

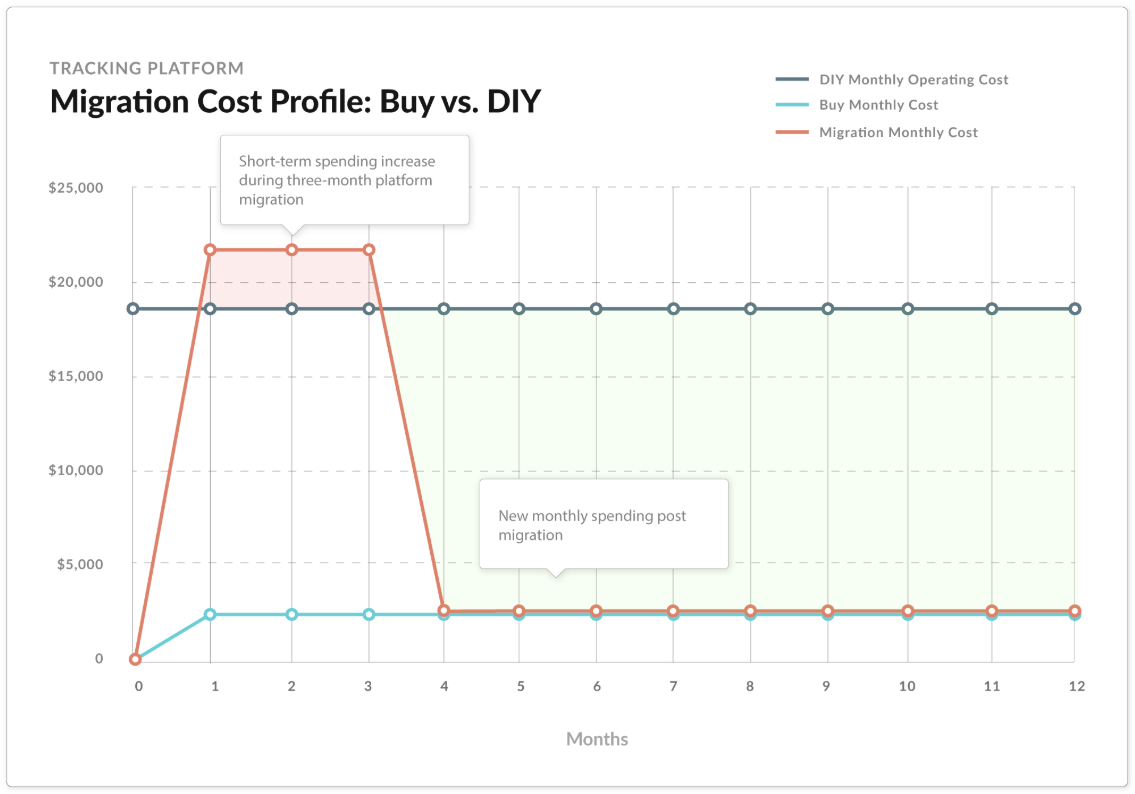

HasOffers customers are able to generate, on average, 40% revenue growth in their first year using the platform. However, this growth is not without short-term migration costs. For example, during migration, ad networks often pay double for their platforms for 2-4 months because their old system must be kept running until all customer data has been transferred. Based on the customer profile and $2,400 monthly ongoing costs previously cited in the interactive graphic, here’s a snapshot of the typical migration costs for a customer incurring monthly costs of $18,500 for the same network performance.

As illustrated above, additional migration costs appear in the red area above and incremental ongoing cost savings in the green area. The net effect of the scenario depicted is a 12-month cost advantage of $137,700.

We were in the market for a new platform to migrate to from the one we developed in-house. We did the full competitive analysis of all the platforms out there and felt that HasOffers was the most flexible, elegant and cost-effective for our business. I’ve been through two network migrations in my career and TUNE, by comparison, was remarkably easy. It was very easy to train the entire company and get them up to speed so that on day one we were using the platform to its full effectiveness.

- Matthew Lord, Chief Strategy Officer, Adperio

Our previous tracking platform didn’t have the capabilities we needed to grow. We knew we needed a new platform, but were worried about the time it would take to migrate. With HasOffers, those concerns disappeared. Our account manager assisted us in every step of the migration process, from contracts to API documentations and everything in between. The entire process was seamless and the speed with which we migrated meant that we didn’t lose any revenue or data in the process. With the support of HasOffers, we increased revenue 80% within 6 months.

- Becca Woolsey, Head of Network Operations, Ad Attraction

The Proof is in the Data

As illustrated above, additional migration costs appear in the red area above and incremental ongoing cost savings in the green area. The net effect of the scenario depicted is a 12-month cost advantage of $137,700.

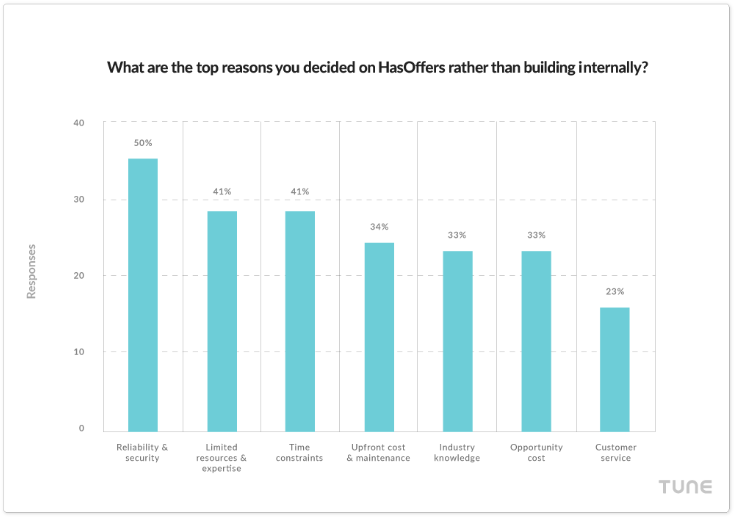

The main reasons that clients choose HasOffers relate directly to saving time and money. According to customers, these are the top five reasons ad networks choose to migrate to HasOffers:

- Tracking and reporting (79%)

- Customer support and expertise (43%)

- Intuitive UI (41%)

- Flexible API (39%)

- Publisher management (33%)

Additional Reading

Ad network owners, managers, and CTOs are under constant pressure to deliver innovation and revenue. For those just getting started, the decision of whether or not to buy core platform technology has become increasingly straightforward and heavily favors Buy scenarios. The advantages, to the top line as well as to risk management, have been proven to far outweigh the costs. At the top of the list is the observation that when networks dedicate their time and energy to differentiation, they’re able to deliver more customer value and achieve better return on their time and resources. The same principle applies for those seeking to migrate to a new platform. For additional perspective on Buy vs. DIY, download the Kiip case study to learn how moving from an internally-built tracking platform to HasOffers saved them 50 hours per month while growing revenue by 25% and campaign volume by 30%. The revenue and efficiency advantages of migrating to HasOffers are also on display in the Ad Attraction case study and related content on the HasOffers resources page. For more information, visit hasoffers.com.

Scalable Platform for Managing Complex Performance Partnerships

TUNE makes technology that powers successful performance-based partnerships across mobile and web. Our flagship product, HasOffers by TUNE, is the industry’s most flexible SaaS solution for tracking, optimizing, and managing mobile-focused affiliate programs. Headquartered in Seattle with hundreds of employees worldwide, TUNE is trusted by innovative affiliate marketers, the largest mobile advertising networks, and iconic brands across the globe.

To try TUNE free for 30 days, visit tune.com/get-started.

Author

Becky is the Senior Content Marketing Manager at TUNE. Before TUNE, she handled content strategy and marketing communications at several tech startups in the Bay Area. Becky received her bachelor's degree in English from Wake Forest University. After a decade in San Francisco and Seattle, she has returned home to Charleston, SC, where you can find her strolling through Hampton Park with her pup and enjoying the simple things in life.