Meet the CMO

Michelle: I started my career at Continental Airlines, and other large Fortune 500 companies. There I gave a WOW presentation of adding images to individual emails. It was very high-tech and everybody was very afraid of it, and the person who was on my IT team said that it was not safe. I think we’ve all known…

Peter: Depends on what it is.

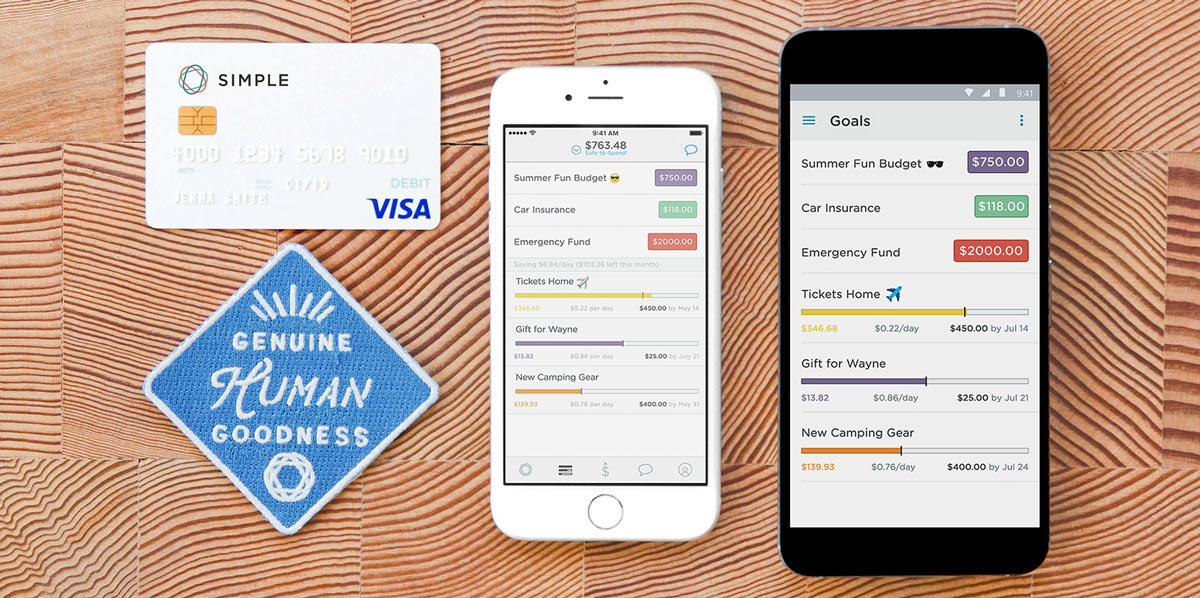

Michelle: Yeah, exactly. That’s true. You know, this a relatively small group of people here, and so giving some of the background of, like, hey, yes, we are now, like, all part of this C-suite. We also all remember how hard it was when we were trying to do mobile or trying to do email or trying to do something that was new where people didn’t really believe in it. People thought that, you know, this newfangled thing is a fad. And so, you know, I had a really hard time at the big Fortune 500 companies because I always wanted to do big things. I’ve always loved the internet. Before I was in business I was a nerd, and I learned how to do make-up, so it’s down deep in there, the nerd-ery. So, I didn’t really want to work for these large Fortune 500 companies anymore, so I switched over to the land of startups, and I worked as an early employee with Yelp and Uber, where we basically did the exact same thing we did at large Fortune 500 companies, except with no budget and no resources. So, we just worked really, really hard and we got to do really fun things, and that brings me to where I am today at Simple. So, Simple is an online bank that doesn’t charge those onerous fees that the big Fortune 500 banks charge. Probably you all have gotten something in the mail or email where you’re like, this is a nasty fee, this is something that is the worst thing I have ever received. Yeah, I see a lot of hands going up right now. We realized that that was garbage. There’s no reason to actually charge those fees to people who are saving their money there. So, we are no-nonsense banking. We’re all mobile banking. You don’t get charged fees for that.

Peter: And so, what has the growth of the company looked like since you’ve been there and what have been your main focuses so far?

Michelle: Absolutely. One of the things I thought was most interesting during my tenure at Simple is when I started, it was just this bank for techies in San Francisco and here in New York, and that was really it. It was just the people who were really willing to try something new, and I’ve actually recently created this plot that shows how Simple has grown. And so, not only has it grown from these two cities, but it grew up the coast and towards the middle of the country, and that pattern for me is a marketer’s dream come true, because trends start on the coasts and they move into the middle, and when I saw it moving to the middle, that’s where I knew that we were actually doing something really cool, that people in these secondary markets were actually leaving their banks and coming to a new way of doing banking.

Peter: Yeah. So, let’s talk about that customer a little bit. I mean, obviously, so, TUNE does mobile marketing, and we, of course, came from desktop as well. Happy to make the transition. With Yelp and Uber, early adopters in mobile category, folks that we’ve worked with as well, and so there seems to be sort of a rising tide of… You know, these people are adopting these early platforms and what they’re looking for next. We talked a little bit about what your psychographic profile looks like at Simple. Yeah, I’d love to hear about how you came upon that and what that looks like.

Michelle: Oftentimes, when people talk about who is your customer, they either commit two fatal sins. They either say anyone, which I hope if anybody ever says that you just walk away from them. That’s the best response. Or they say, “It’s women ages 30 to 35 who live in Tulsa, Oklahoma who like the color pink,” and you’re like, that is not a human being. Yeah, that is kind of sad, and I think even the person who lives in Tulsa, Oklahoma who likes pink…

That marketing, it panders, it creates stereotypes. It’s pretty ugly. So, what we try to go after is psychographics, and what psychographics help us do is say this is actually the motivations of these folks who can be helped by your product. So, the psychographic for a Simple customer is somebody who is mobile first. That person who, back in the late ’90s, cut their phone line and knew that they were just going to go mobile, the type of person whom you say what television show is what channel goes, “What? The internet.” They have not had cable for a very long time, and when they go to the airport, they know not to wait in the cab line but they’re able to just call an Uber. So, that’s the psychographic of our customer.

Peter: So, let’s start from the very top of the funnel. How do you find these people in the first place? How do you have that very first touch?

Michelle: Yeah, absolutely. Well, the first way is actually, we had those seeds of community in both of those big cities. So, you know, just a couple people who would try it out in San Francisco, a couple people who would try it out in New York. And we really built a very robust referral program around them.

We created a referral program that actually incented people to share Simple with their friends. So, we wanted to make sure that people were tweeting about it, that they were sharing it. We used behavioral economics in Simple to make sure that people are doing the right thing. So, maybe a great way to explain this is to say your bank currently is not incented to have your best interests in mind. Your bank actually makes money when you make a mistake. So, your bank makes money when you overdraw. Your bank makes money when you are confused. So, we want to make sure that we’re actually adding bits in that says when you save and you reach your goal, you’re actually excited about it. You have a way to share. So, they built sharing into the system in a way that doesn’t feel like we are trying to gouge the customer, or say, like, “Share that you’ve done this really weird thing.” It’s actually something you’re excited about and something you want to share with the world.

Peter: So, in the beginning was that one of the main overarching strategies? And how long did that go one before you started to also dip your toes into other places?

Michelle: Yeah. So, that lasted for a solid couple of years, really. That was the best way to do any marketing. Yeah. And so, it’s actually not slowed down, but we want to grow faster than what it will allow us to do. So, now we have a lot of advertising that we have layered on top.

Peter: And what are some of the big challenges that you’re excited about right now that you guys are working on?

Michelle: Yeah. So, Facebook programmatic advertising is probably the best channel for us. The way that we measure the effectiveness of a channel is not just what gives us the lowest CPA. A lot of marketing, you’ll see, you know, this CPA, this cost per acquisition, is pretty small. People are very happy. But what they don’t measure is how profitable was that customer for you. Not all customers are created equal. How good is that customer coming through that channel? So, we try to measure it all the way through, and Facebook provides us, actually, the best customer, because we’re able to match those psychographics.

Peter: It’s a lot of challenges in that funnel. I mean, everyone’s got some kind of blockage in their funnel. For us who see most of our customers, just getting to download an app is a major challenge. And, of course, there’s starting to be some advancements where we’re going to have instant apps soon, where you can use part of an app before you actually have to download it and those sorts of things. But yeah, how do you guys handle some of those barriers? What are maybe some of the biggest barriers in your funnel? And then how do you focus to have the highest performance around it?

Michelle: Yeah. So, the biggest barrier in our funnel is actually that we are a bank, and so the consumer companies I’ve worked for before, if you wanted to sign up, you were allowed to sign up. Banks actually have a really onerous funnel where we have to have your social security number before you can sign up, we have to verify your identity before you sign up. Most of the time, it’s very difficult to verify somebody’s identity online. So then, people have to go through a relatively onerous process of proving who they are. That said, we want to make sure that we’re getting those folks who are really excited about what we have to offer so that they’ll go through that onerous process. So, if we’re getting people who are like, “I don’t know. I’d like to try the app, but I don’t know,” they’re actually not going to be a great customer for us. We want to make sure that they really understand what this brand is all about so that they’ll get through that entire thing. It’s not as easy as signing up for Uber.

Peter: So then, what does the app mean to your customer for your business? What is the real value that you’re providing with the app?

Michelle: So, the app is actually the main way that you interact with the bank, and so what’s really great about it is that any given time, you can open up your app and you can see how much money you have in your account, and why that’s different than other bank’s app is we actually decrease the amount that you have in your account based on what bills you have coming up. So, if you have $1,000 in your account, for example, and your rent is $500, we don’t tell you have $1,000 in your account. We let you know you have $500 in your account so that you have that money set aside, so that in time you can see what is called “safe to spend”, and you know what is safe to spend. The other thing that you can do is you can actually block your card from within the app, so if you ever lose your card, like right now I don’t really know where my purse is. I think it’s over with these folks. But if I got off the stage and realized that I couldn’t find it, I could block the app. And so, it’s actually turning you into the teller, so you don’t have to deal with all that nonsense of going to a bank and trying to get somebody to do something for you. You are empowered to do it all yourself.

Peter: So, did you ever do direct user acquisition for the app itself? Did you dabble in that for a little while and then just decide there was a better path? What happened? The experiment process.

Michelle: No, no, no, I’m going to ask you a personal question. When was the last time you have found something this awesome through the app store?

Peter: Um… [Laughs]

Michelle: That is the best answer I’ve heard.

Peter: I can’t name it right now, but I’m sure there was something amazing.

Michelle: Sure. Are you sure?

Peter: Absolutely. Apple’s not listening to this. [Laughs]

Michelle: Well, it’s a garbage experience for most people, honestly. Like, when you go to the app store, you don’t actually find anything through the app store. You usually have some form of intent when you go to the app store. You don’t go to the app store going, “All right, app store. Wow me now.” And marketers, for some reason, feel like that’s what people are doing within the app store. So, sure, you should test. You should see if you can do things within the mobile app store. But what you really need to do is acquire those customers through some other means, or get their intent when they’re going in so that they’re actually searching for your particular product. It’s very rare that you’re going to intercept them within the app store.

Peter: Yeah. Well, especially within the app store. At TUNE, most of our customers are focused on app user engagement and trying to drive downloads. Certainly, the conversation has shifted dramatically towards actual sales and registrations that occur within the app. But still, you know, that barrier really is pretty powerful in getting into the app itself, and so we’ve also seen a rise in web, actually, and it’s kind of funny to maybe be talking about the rise of the web in a mobile context. But especially for financial organizations like this, or maybe you’re trying to book something like a last-minute flight or hotel, and yeah. I mean, certainly there are some great apps for doing this, but if you don’t have them yet, then maybe we need to end up in the experience that has already existed for a while on the web, and let’s get this transaction done and moving onward. So, what has the web meant for you guys in your acquisition funnel?

Michelle: Yeah. So, how I like to look at all of our marketing efforts is I look at it like a brick wall. Like, you cannot see through this brick wall at all. And you usually come to conferences like this to tell you which of these bricks should I push. You’re kind of hoping for that magical brick, that it’s going to be gold and you’re going to hit it and all of your marketing efforts will coming out. Right now, these bricks represent channels or different ways of doing marketing. And instead of saying, “Let’s look for the golden brick,” what you really want to do is systematically say, “Is this brick the one that I can push? Is this brick the one that I’m going to push?” And when you notice the one that you’re going to push, you start pushing that more. But you continue to push all of these other bricks, because you want to test continually, because you just do not know what is going to work for you. So, we test mobile every once in a while and it’s just not a brick that’s really being pushed. So, we tested mobile web, and that brick pushed really hard. We were like, holy cow. The web is actually the way to get people to understand that we have a mobile product, because their intent wasn’t there going to the store. So, we get a lot of sign-ups from mobile web particularly.

Peter: And also, you know, the technologies and platforms have really advanced in the last couple of years. I mean, before it was really difficult just to make sure you sent someone to the web if they didn’t have the app, you know?

And now it’s just starting to become pretty commonplace technology. You guys are familiar with universal links. Everybody, heard of universal links? Okay. Wow, that’s pretty good. And we were talking about today, you guys are kind of getting into deep linking pretty heavily, and universal linking as well. So, these are just common terms amongst your team? Everybody understands the technologies and they’re able to deploy them? And at this point, do you feel like they’re really integrated into your marketing activities, or are you still needed to develop further to get to that point? I know that most marketing technology stats are not really connected to your deep linking, universal linking. So, what does that kind of look like for you guys right now?

Michelle: So, I will never say that it is good enough. [Laughs] You know, the death of all marketers. But right now, what we’re seeing is we want to ensure that people are going to the right place for their intent, and so the way that we have it built right now is not sufficient for us. So, we’re actually out there talking to partners all of the time, and I’ll actually take a little bit differently and say that talking to partners is always really interesting, because each partner will say that they do the exact same thing, and it’s actually really in conferences like this that you can talk to people who have actually used these platforms and say, “Do they actually do what they say? And do they do it easily?” In which, if you’ve brought on any new marketing manager, they also could do this activity. Because what we’ve seen before is with these platforms, one marketer will put something together with tape and bubble gum that really works for them and works for their workflow. And they get promoted, they leave, they win the lottery, they become a princess. Something happens and they leave your company.

Peter: It’s everyone’s goal.

Michelle: The princess problem. They leave. And so, all of a sudden, everything that was connected together is no longer connected together, because we have this idea that, oh, at a big company, it’s so easy because everything’s connected together, or at a small company it’s much easier because you don’t have technical debt. And I’m here to tell you, any company I’ve ever worked at, and I’m hoping this isn’t my fault… But it’s all a mess. It’s all like when you look behind your TV, you just see that link of cables all together.

That’s why we always want to get to the promised land, but then another platform comes out and you want to add that in and you want to try it out. So, it’s that continual testing and being comfortable with the mess behind…

Peter: Yeah. I think it’s a really interesting perspective. I watched the panel CMOs one time, and it was like at a LUMAscape conference. Of course, everyone’s seen the LUMAscape. There’s, like, just an enormous number of companies across ad tech and MarTech and everything, and you know, the moderator asked the question, you know, what is the marketing stack, the cloud that’s just owning it for you today, the one that is just winning the category that you trust completely? What technologies are really interesting to you? And for them, every single one of these Fortune 500 CMOs named companies I’d never heard of.

Like, Point Solutions, like Start Up Pieces, and I was like, what? Where is Oracle? Where is Adobe? Where is all of these folks and why are those not the first words out of your mouth? Because I know all your marketing stacks are built on that stuff, but they couldn’t even utter the words. So, it’s really interesting, and I think it relates to what you’re talking about, where they’re just thinking about they need to solve this problem and pull this together and pull these pieces together. You’ve got some homegrown things, as well, that you’re kind of trying to fasten together.

But I also think that part of it is this real separation between what is my marketing technology stack, or my CRM, even, and my ad tech stuff. Right? I’m buying from all of these channel partners, and maybe they’re giving me some stacks and they’re giving me some of my analytics, and then I’ve got all the stuff from my first party CRM, and all my customers are doing this. Here’s what was inbound and organic, right. But these things are not really talking to each other. They’re not really connected to each other. And so, you end up with this real problem of what really caused this customer to go through this web funnel experience, the sign up. Do we have a long-term customer? How do you guys kind of handle that today, that sort of disconnection between ad tech and MarTech?

Speaker 1: Yeah. Well, right now, we make sure that we’re actually creating an ecosystem within the team that makes sure that folks are talking to one another actually verbally.

Actually verbally, and that we’re creating the proper incentive structure so that we’re not incenting one team to go sandbag, do something that would make the rest of the business fall down. So, one of the things we were talking about backstage was if you incent your paid marketers in a certain way, they’re going to gather up all the leads and say, “These were my leads.” Well, the organic team actually doesn’t really have a leg to stand on because there’s no way for them to show that they were actually bringing in those more valuable customers, and you want to make sure that you were creating an ecosystem within your team that has the higher purpose of the business in mind. And so, one of the things from our industry that we’ve been talking about a lot is the Wells Fargo incentive structure. As we all know, Wells Fargo was signing up customers that did not request to be signed up. Were any of these individual people doing anything wrong? That’s to be determined by something else. But we know that the incentive structure was set up in such a way that that team was not helping. And so, as the CMO, I don’t actually think that it’s my job to figure out if all of the pieces are talking to one another technologically. I’ve hired really smart people to do that for me. So, actually, I’ve taken my foot off the gas on your question, because I want to focus on the bigger question of, “Am I building a healthy team who will have the entire company in mind, who is really smart, happy to keep up on these technologies, and will do something for the greater business?” And our entire team knows that the greater business is going to come from organic traffic. It’s rarely going to come from the paid channels.

Peter: I think it’s honestly a pretty rare perspective, and extremely mature. We mostly see the market, you know, sort of the paid teams and the organic teams can be quite siloed and separated, and paid teams being very, very incentivized to just drive down loans.

And of course, yeah, were those downloads… Maybe there was something in their Facebook feed that scrolled past or something, and so we’re going to grab credit for that, but was that really the incentive for the customer? Was that really what influenced them in the path? And we’ve been preaching multi-touch attribution for a very long time. We launched multi-touch attribution for mobile three years ago, and still people don’t use it that much. Right? It’s not really used in day-to-day, like, you know, who was the first touch, who was the last touch. Let’s really figure out really what deserves the credit. And I would say that we even sit down marketers and say, “Well, we’re showing you the multi-touch funnel. You need to decide how you’re going to compensate your publishers.” And the market just says, “Well, I just don’t want to pay for two installs.” So, whichever one needs to claim the credit for that, that’s all that matters, right? So, it’s a really… It’s a strange dynamic that happens there, and I think you’re really smart to say it’s a people problem. It’s really not a technology problem. You know, the measurement part can be done, but if the team is not talking to each other, trying to figure out what really is occurring here and what really was the value of this paid channel, and then what was… Of course, let’s talk about the lift factor.

I’d love to talk about organic lift and how the paid team helped the organic team and how that overlapped and all that sort of thing. And I think, you know, when you have the model, too, that has that organic factor to it where it’s, like, an influence or program. Like, these people are doing it because they have that psychographic profile, they really believe in sort of the future of banking and all that sort of thing. Then you have… You know, you’re able to build a team that has that vision in place.

Michelle: Truly, yeah. Well, I also love that you brought up lift. One of the reasons why I really love having worked at really big Fortune 500 companies in the beginning and then move to startups is I get to explain the concept of incremental lift via campaign.

Peter: Incrementality. How many people use incrementality testing?

Michelle: Okay. Everybody get really excited right now. Incremental lift will blow any marketer’s mind. So, if I send out a coupon to all of you to go buy jeans at, let’s say J.Crew.

Peter: Jeans are too small for me…

Michelle: I remember the teen section was pretty rad. Okay. So, he was not going to go to J.Crew. I was going to go to J.Crew because I had to go the teen section. I’ve given me a coupon and I’ve given Peter a coupon. That marketer is going to say that they incented both Peter and I the exact same way. Bullshit. They did not. They actually over-incented me, and they did incent Peter. So, they actually did give him incremental lift from this campaign. So, they got one extra customer from this campaign. They did not get an extra customer by sending out something to me. And so, if you really want to measure your marketing effectively, you just have to look to science. Science has been doing this for years. So, if we all remember the scientific method, we hold out a control group, and a control group only has one thing different with it, and that one thing that’s different for a marketer, they didn’t get your ad. And when you have that control group held out, you can actually measure the incremental lift on who is actually getting your ad. And when you’re able to measure incremental lift, you are a power player in any meeting that you go to, because you’re not just saying, “Oh, I spent $100,000 and I got 5,000 customers,” and everybody’s kind of looking at you. You’re like, “I spent this much money. This many people would have come anyway.” All of a sudden, you have credibility in the room, because you’re not saying 100% incrementality attribution. You’re showing that you know how to do science, math, and marketing. So, if you’re not excited about incremental, let’s get super excited about it.

Peter: Well, you know, and so certainly there’s a lot of probabilistic pieces to that, and there are some challenges along the way when you think about sort of the timing in incremental lift. Also regions, like locations, like did you run these campaigns in these places and actually saw that lift occur? Have you guys done any experiments that were kind of interesting to you, where you didn’t really think it was going to have that kind of lift impact, but it did? Have you guys done TV radio and stuff like that? But anything else that was kind of interesting? Have you guys tested? Putting you on the spot. 😉

Michelle: Yeah, yeah, no, I love talking about this stuff. So, there’s two ways that I’ve tested incremental lift in the past: direct mail, if you want to go super old school. It’s actually really, really powerful for certain channels. And then Facebook actually does incremental lift testing right now, as well, and so we were able to run a brand ad for a few months at the same time that we were running a call-to-action ad. So, one was just a really beautiful brand spend and it was pretty, had no call to action.

Peter: It was a video?

Michelle: Yeah. And then the other one was a traditional ad for the call to action. We were actually able to see what the incremental lift was from the brand ad. Then we were also, on its own, it would see what the incremental lift was from the call to action ad. Then we were able to see what happened when we put them together. And that was a super powerful way to show, like, hey, this is how much money we can get from one ad channel, here’s what happens if we do a one-two punch, and here’s all we’re going to get on the table if we actually just do the call to action ad. That was only within one ecosystem within Facebook, but I would posit that we could actually extrapolate those efforts to other channels, as well. You can also do something similar with direct mail if you have a large enough group, because then you just take whatever your mailing list is, grab 10% randomly, hold them out, see how they behave, and see if everybody else who got your mail is actually doing something different. These aren’t fancy new ways in doing thing, but they’re rooted in science and they really, really work.

Peter: I think Michelle is awesome. This is really amazing. In the last… I want to wrap up, at least, our talk a little bit about marketing, storytelling, and that sort of thing. But also, we’re going to take a couple of questions maybe from the audience, if you’re prepared and it’s a good question. There are dumb questions. But we were talking backstage a little bit about some of the things that you guys are getting involved in, getting excited to step into things like VR and these experiences, and what that means for storytelling as marketers. All the stuff that we’ve talked about leading up to now sort of supports the storytelling part, right? But what does that mean to you and your career, and what does that mean to you now at Simple?

Michelle: Yeah. So, a lot of these tactics that we’ve been talking about are up here–digital marketing, growth hacking, direct mail, whatever you want to call it–really only works if you have a solid brand proposition. As a marketer, I would much rather have very few customers and a story that people go gaga over than a ton of customers where people are like, “I dunno. Comcast?” Yeah. And so, it’s really important to me that we create really compelling narratives around why we’re selling what we’re selling. And so, it’s not that story that you tell your boss. It’s actually the story that you overhear two customers telling one another in the elevator. So, what I always ask at the companies I work at is, like, when you go in an elevator and you overhear your customer telling another customer what you’re all about, what do you want them to say?

That is exactly your brand. That’s totally your brand, and you need to make sure that you’re using those exact words consistently. You need to make sure that the company is actually living that every single day, because I don’t know about you, but I’m definitely not into companies where you have this brand out there in the world, and then you go into the company itself and somebody’s crying at their desk to the left. This isn’t how you’re operating internally, and you’re wondering why the company is not moving forward. And it’s because you’re trying to push forward a lie. And so, to me, it’s really important that storytelling is at the heart of everything that we do, because those stories will go further than just some weird marketing message that we want to tell.

Peter: Yeah, and honest stories, like you’re saying, right? We found it really differentiating in the B2B category for TUNE… First of all, we’re called TUNE, and people are like, “Are you, like, a new music streaming app in Silicon Valley?” And we’re like, “Absolutely. And we can do other things, too.” But we have a lot of fun, you know, in this BB world. We have to do things that are off the wall and things that people remem2ber, and we’ve got to be connectors and get people together that might not have had conversations otherwise, and those kinds of things. And, you know, figuring out how you stand out in that sort of very, very slow…just bad, pharmaceutical branded B to B space. It’s really interesting. It’s obviously not that hard to do if you just take the time. But you’re right that if it’s not your culture and it’s not kind of who you are as a marketing team or as a business, then it’s really, really hard to develop that. So, we should, yeah, I don’t know, focus on the heart first. Something like that.

Peter: So, do you have any questions for Michelle and myself?

But wait, there’s more!

Question 1: How many bricks do you typically push at any given time? And do you do that programmatically or manually?

Michelle: Great question. All in both is going to be my main answer. So, one of the things when you come to conferences like this, people will say, like, “Oh, you do this, you do that, you do all those other things,” and you get back to your desk and you think to yourself, I’m doing nothing right and I have to do everything. And it’s not true. You have limited resources. I don’t care how big of a company you are. You only have so many people on your team, you only have so many hours in the day, and you have to be really thoughtful about how many tests that you actually want to run. And so, it’s really about how many people you have that are willing to cycle through this on a regular basis. So, at any given time, we’re probably testing between six and eight different channels with, depending upon the channel, 20 different pieces of creative. And so, for some channels where we are able to do it programmatically, meaning computers and robots can do it all for us, there’s actually thousands of different permutations of any ad in any given time. Before we want to set up that programmatic advertising, we actually just want a human being to go in there and try one at all. So, for example, we tried a pre-roll YouTube ad. We spent a lot of money on it, and I would like the audience to guess how many customers we got from this ad. One. One customer. And I’m so fascinated by this customer, I want to figure out who they are and I want to talk to them. I want to ask them why. Why? Who are the people who saw this ad? Did you fall on your computer and sign up for a bank account? Why did you do this? So, that person was in my heart a lot, but it’s not an ad that we’re going to run again, even though I’m clearly quite fascinated by it. So, and thinking really clear on what your testing methodology is and ensuring that all your people are testing as much as possible, but not putting yourself into a position where you think you have to test everything.

Question 2: Did you really expect a lot of sign-ups from that YouTube ad? Did you expect sign-ups from that YouTube ad? It’s part of the brand’s storytelling aspect, right?

Michelle: That’s exactly what we plan on doing next, is actually planning it actually more as a brand ad than a call to action ad. But we wanted to see it first, like, could this work as a call to action ad? We want to make sure that we are being humble and we don’t go forward with thinking I know what the outcome will be. We go forward like a scientist who says we have a hypothesis. But we have the humility to say, “I don’t know. Let’s just try this and see what happens.” And if it works in some crazy different way, which happens quite frequently, all of that. In this case, like that one person who’s, like, nine views. But yeah, now we’re going to try doing it as a brand lift test.

Peter: I love that video has begun bridging this gap of brand and performance. Like, certainly it’s encouraged me to really do storytelling digitally, right? And it used to just be interstitials, banners, all this kind of stuff in the sidebar and all that kind of stuff. And now, mobile lets you take over the screen for a minute and tell a really great story. So, yeah, what has that been like for you? How do you think about using video really strategically? Do you have a video team that’s working on these things, and how? What do those look like?

Michelle: So, video for me… So, you say taking over the screen socially, the only time I want to do that is when we’re already the bank that the customer wants. So, I don’t want it to be a screen takeover, because I would hope people would just be like, “That’s garbage.” But what I do want to do is if you’re asking a question via customer service, a video is a great way to explain it. So, if you have a question about something, there could be a video answer for that. Like, when you want to use videos when you need to explain something that’s somewhat difficult, or you’re going to have an emotional response to it. So, when people are going through the marketing, it’s not just the acquisition portion of the marketing I want us to focus on. I want to focus on the entire life cycle of that customer, and that’s where we think the video really plays a huge role, when somebody has a question, somebody gets stuck, when we introduce a new feature. That’s where video can come up and be really powerful for us.

Question 4: You mentioned you’re targeting on Facebook. Are you using any other targeting platforms?

Michelle: We use primarily for Facebook.

Question 5: Any other channels you guys are testing that are better?

Michelle: Our two biggest ones are the biggest players, which is Facebook and Google AdWords right now. [00:35:40] testing Twitter, which is rare. We never have any good results. [00:35:47] any of those, as well, are working really well. And then actually, a homegrown solution for affiliate ads has been really helpful because it’s such a niche audience.

Question 6: Are your affiliates Simple customers? So, like, it’s influenced your style? Or these are, like, professional…

Michelle: A mix of both.

Question 7: Are you finding the traditional customer or is it really going after new millennial-type bankers?

Michelle: Great question. So, this is new people who have never had a bank account, folks who have had bank accounts before. Most people have had a bank account before, and so it’s usually folks who are really willing to try something brand new. So, the answer is both. They’ve had bank accounts before, but they generally are in what is considered the millennial demographic. That is a term that has been banned from the marketing team. We actually have a plugin that whenever anybody says “millennial” it replaces it with “snake people”, because that makes us realize that…yeah, that you’re a millennial. If they don’t like, you shouldn’t say it. It’s actually [00:36:51] language. And so, making sure that we’re actually talking about who it is that can benefit from this. But yes, if we have to put an age demographic to it, we’re not huge with the senior citizen crowd.

Peter: This has been really, really fun. Thank you so much for spending time with us. Thank you.

Author

Becky is the Senior Content Marketing Manager at TUNE. Before TUNE, she handled content strategy and marketing communications at several tech startups in the Bay Area. Becky received her bachelor's degree in English from Wake Forest University. After a decade in San Francisco and Seattle, she has returned home to Charleston, SC, where you can find her strolling through Hampton Park with her pup and enjoying the simple things in life.

Leave a Reply

You must be logged in to post a comment.