Twenty years into the desktop explosion and a decade after the mobile revolution, bricks and mortar is still 88% of all retail commerce in the United States. But that doesn’t mean that shopping is the same.

In fact, it’s never been more different.

As we saw last week, the best brands are walking alongside their customers at home, in the workplace, online, and in-store. With permission and while respecting privacy, they’re engaging with customers deeply on-demand — when their customers want it.

That’s happening via signed-in experiences across three major clusters of channels:

- Mobile (Taps)

- Desktop (Clicks)

- Physical Location (Bricks)

Mobile is the key and primary mode of connection, and it’s still growing fast in terms of economic activity. But the physical store location is still critical.

This is part two of a five-part series on omnichannel customer engagement highlighted in our new e-book, “Taps, Clicks, Bricks: Omnichannel Customer Engagement Is the New Brand Superpower.” Download the full e-book for free here.

- Buying Is Changing: Hard Data

- Shopping Is Changing: The New Customer Journey

- The New Retail: Silicon Valley and Main Street Are Converging

- Playbooks: How Top Brands and Retailers Are Winning

- Getting Started: 5 Critical Components for Success

Let’s explore why … and how it’s changing in spite of the “retail apocalypse.”

Shopping Is Changing: The New Customer Journey

The data on m-commerce, e-commerce, and traditional storefront retail is compelling enough. People are voting with their feet — and their fingers — and we see an emerging picture of brand and retail sales and service that embraces both technology and location.

That becomes even more clear when we ask 2,750 people how they like to research, shop, and interact with brands.

Brand Encounters Are 60-90% Mobile Moments

Brands often say hello to new prospects or catch up with old customers on mobile.

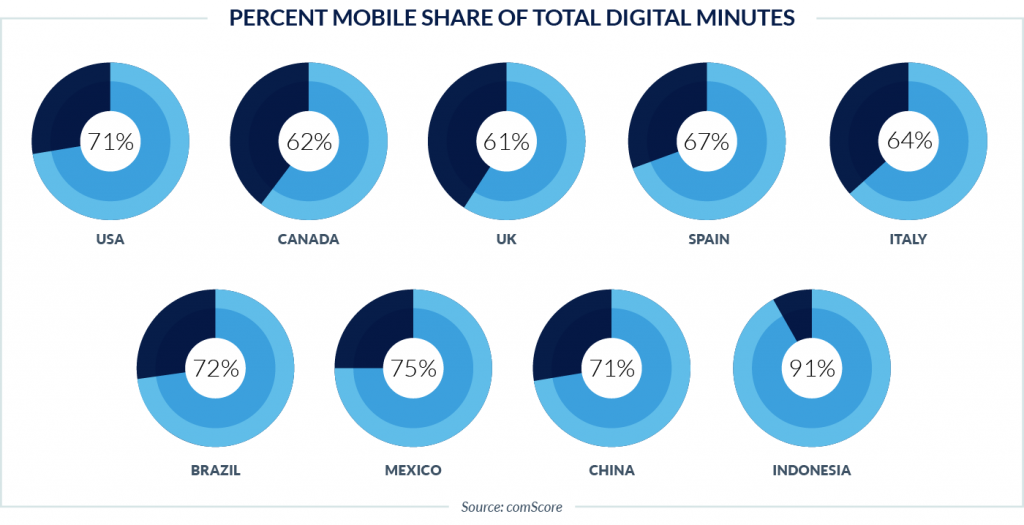

This is simply a function of where people spend time with digital media. In the U.S., for example, 71% of consumers’ digital media time is spent on their smartphones and tablets. In Indonesia, the equivalent number is 91%.

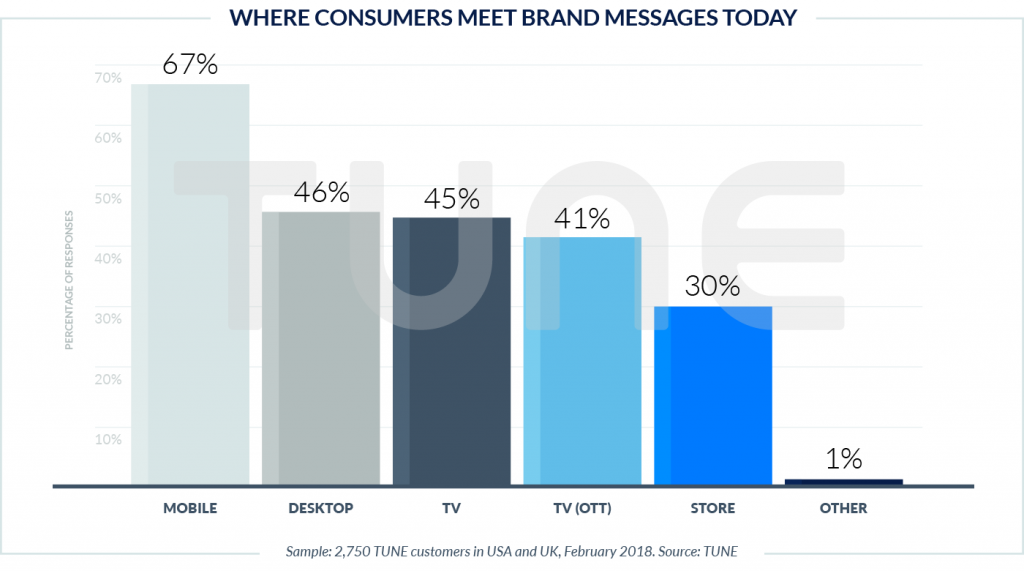

That’s reflected in our recent survey of 2,750 consumers in North America and Western Europe. 67% of respondents said they mostly see brand messages on their phones or tablets.

It’s important to note, however, that most consumers encounter brands across a wide range of digital media. We asked respondents to select all that apply, and 46% said that desktop is still an important meeting point with brands, while an equivalent number said the same about old-fashioned TV.

Interestingly, stores are still important at this initial phase for 30% of consumers.

Also interesting: Younger people over-index on mobile and streaming TV (Netflix, YouTube, Hulu), as expected, but also over-index in one other place that’s not as expected: physical stores.

Mobile’s not where people just meet brands, though.

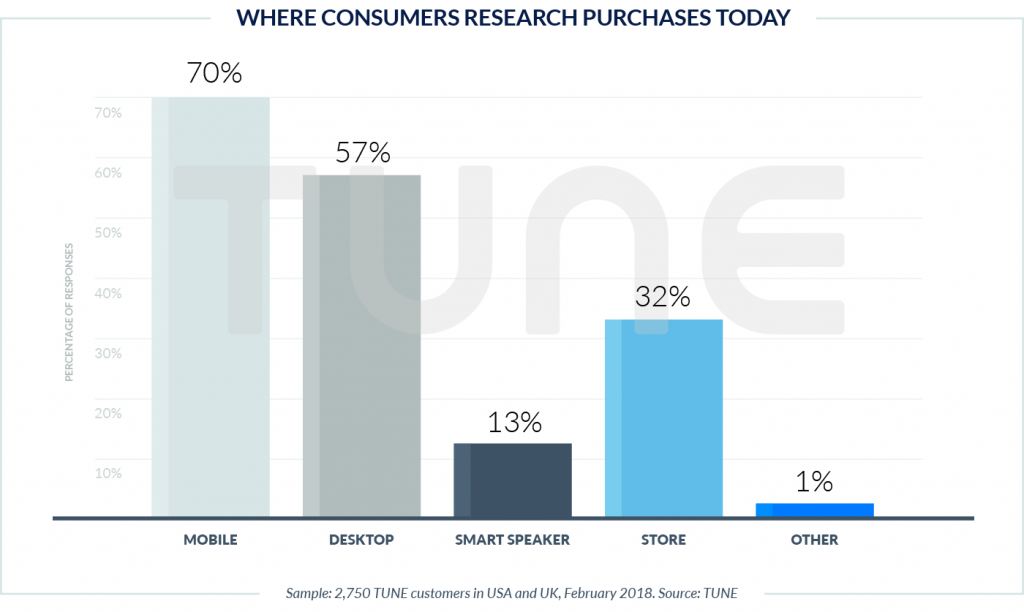

Clearly, when people research brands, they use multiple methods. Mobile’s the easiest, because it’s always at hand, but desktop is also popular: it’s easier to go in-depth, see more details, compare options, and open multiple browser tabs on a larger screen. Security may be perceived as better on desktop as well.

Again, mobile unsurprisingly skews young.

Smart speakers also skew young. Approximately 18% of respondents ages 14 to 34 like to ask Alexa, Siri, or Google Assistant for information about their potential purchases, compared to just 9.2% of respondents ages 35 or older.

For every age range, about 30% of responses and 1 in 5 respondents state a preference to do product research in an actual store.

Desktop Is for Digging: 63% of Consumers Research Travel on Computers

The customer journey is complex and we won’t explore it all in this report. But early stages — initial encounters and subsequent research — are critical phases.

While desktop is not the most critical place for meeting brands in North America and Western Europe, it is one of the most critical places for winning the research and evaluation phases.

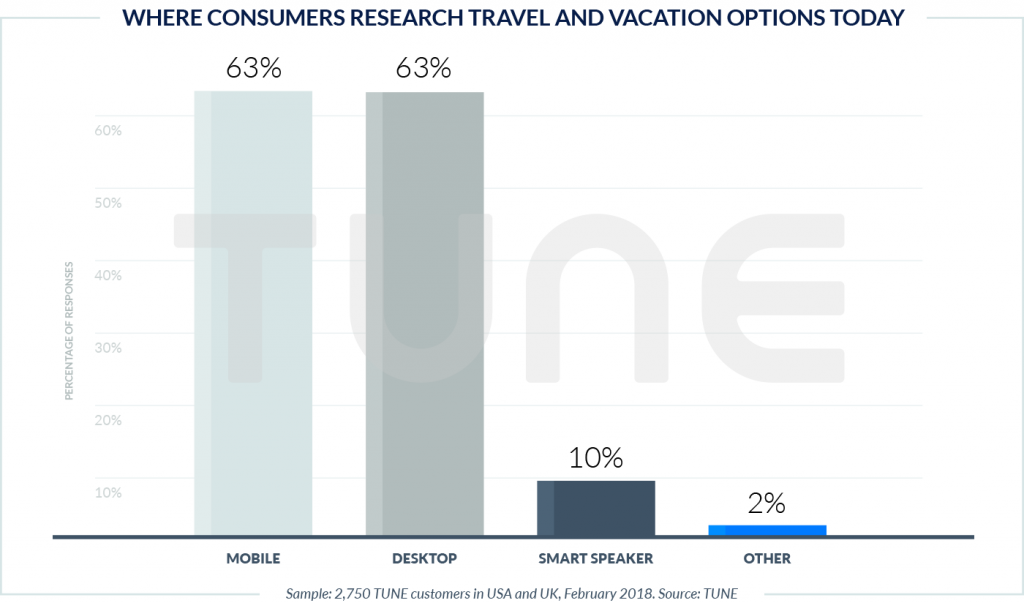

Desktop ranks second to mobile on the research phase, as we see above, but that changes when people are researching complex purchases like travel and vacation options, where it’s neck and neck with mobile: 62.8% of our 2,750 respondents said they researched travel on their phones; 62.65% said they did so on their desktop computers.

What we’re seeing is that the two options are not really in competition.

Mobile and desktop are in collaboration: most people take different steps of the same customer journeys on multiple devices, using each for what it’s good at. Mobile is the king of accessibility: it’s always 3 feet or less from your body. Desktop is the queen of depth: it shows comparisons, large pictures, and complex data.

Stores Still Matter: 49% of Consumers Prefer Physical Stores for Basic Purchases

People like to buy in real, actual, physical stores.

They really, really like it.

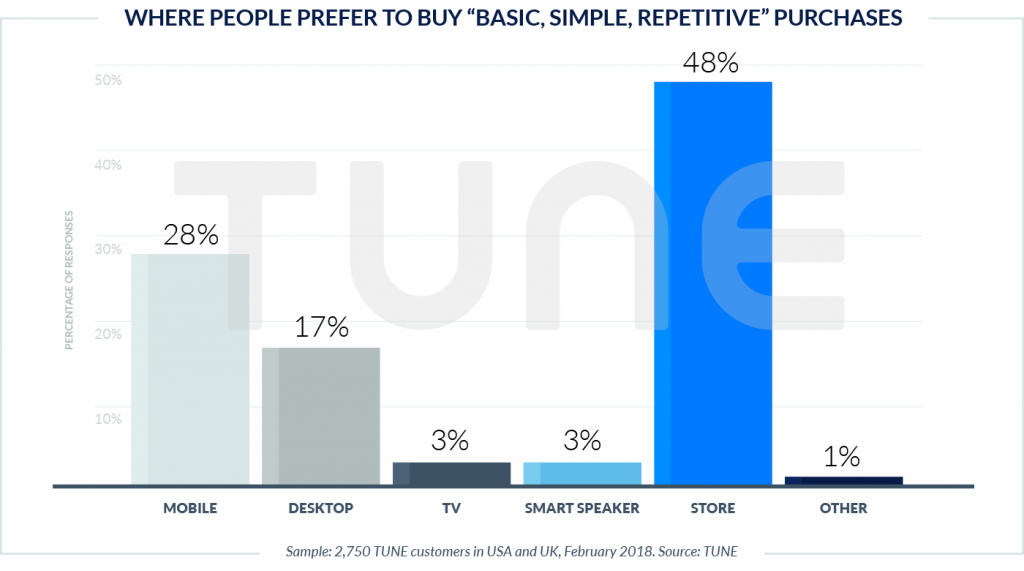

In fact, 49% of respondents picked stores as their favorite place to buy even basic, simple, and repetitive purchases. Another 28% said their mobile device is their favorite place, and — contrary to the hard data on where purchases actually happen — 17.5% prefer their desktop computers. Just 3% of people said a smart speaker like Amazon’s Echo, Google Home, or Apple HomePod is their preferred way to purchase.

That changes with age, but not much.

Around 44% of people ages 14 to 34 still prefer a store, while 34% prefer their phone, and just 3.8% picked a smart speaker.

The sweet spot for voice commerce seems to be age 25-34, where people are young enough to be open to technology and old enough to afford all the toys: 13.2% of consumers in this age range pick the spoken commerce option.

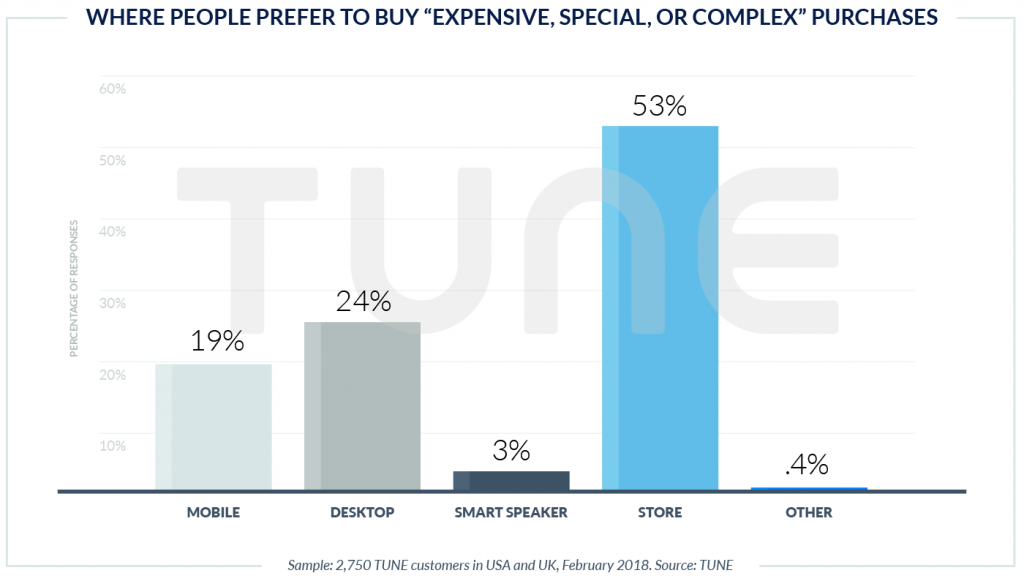

As one might expect, stores and computers index higher for more complex or expensive purchases. (This holds true for all age ranges in North America.)

The reason is simple: In spite of considerable effort by marketers to use augmented reality, virtual reality, virtual sizing tools, and other technological marvels to entice consumers to experience products without physically being in contact with them, people still want to feel, touch, smell, and experience them.

And, sometimes, people want help from a real, present human being to validate a purchase … or to return one when problems arise.

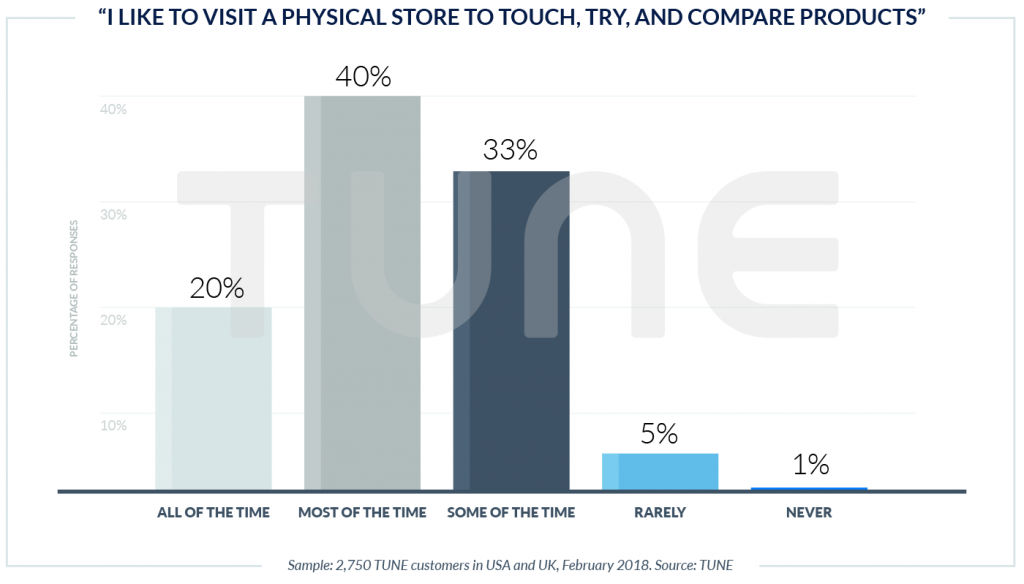

Around 3 in 5 people, or 61%, like to visit a physical store to touch and try products, or to get quick exchanges, all of the time or most of the time. Only 6.4% rarely or never want to go to a store.

That’s not just old fogies: 68% of respondents ages 14 to 34 said they want to go to a store all of the time or most of the time, as well.

On Mobile, Brands Need Both Apps and Web

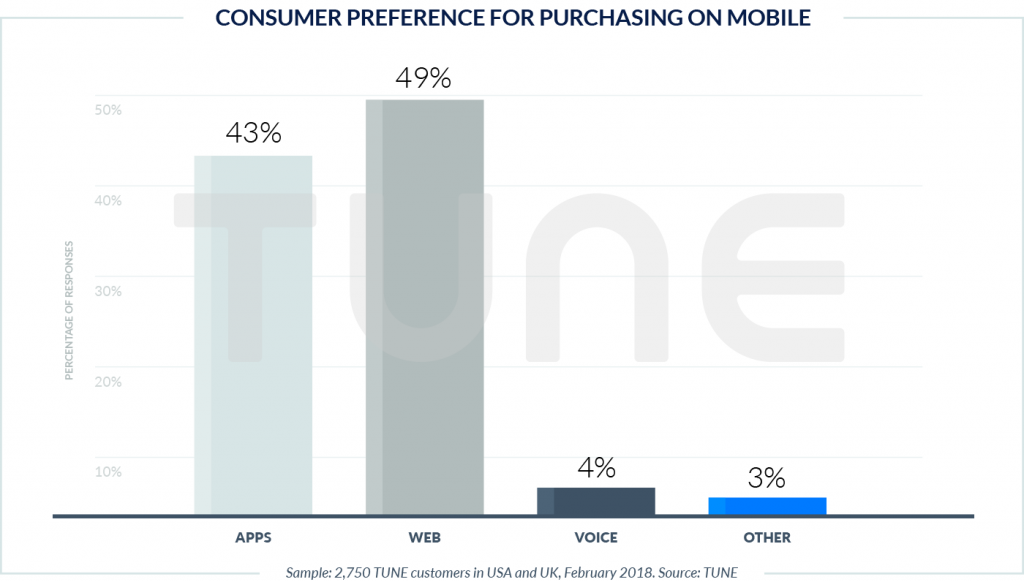

Brands need both apps and web to compete effectively for consumers’ dollars.

Consumers are split almost down the middle when it comes to making purchases on mobile, with a slight preference for using mobile web (49%) versus apps (43%). Interestingly, while the numbers are still close, that preference is reversed for younger people: Consumers ages 14 to 34 prefer apps to mobile web, 50% to 44%.

However, apps are critical, and not just because 1 out of every 2 consumers prefer to purchase with the Amazon or Starbucks app instead of a mobile browser. Apps are critical because a brand’s most valuable customers tend to be dedicated app users (which you’ll see in the interviews that follow). In fact, the VP of digital marketing for GameStop once told me that his app-using customers were more valuable than the top-tier members of the company’s loyalty card program.

Post-Purchase Matters: 76% of Consumers Stay In Touch

While this report focuses mainly on initiating the customer journey, the entire journey matters, and increasingly so with smart configurable products.

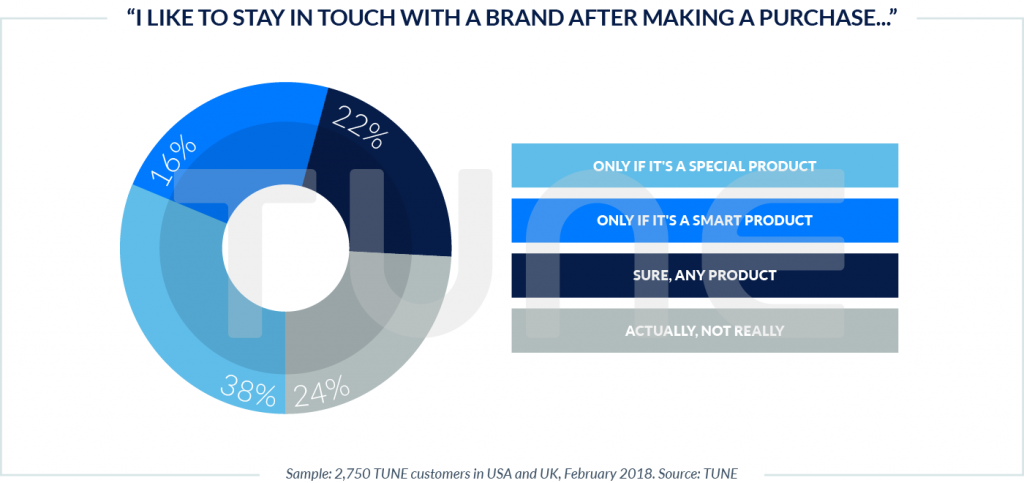

A long-term customer is clearly more valuable than a one-off purchase. Luckily, a majority of customers are just fine with brands staying in touch. That’s especially true when a special or smart product is involved.

Of course, smart products totally change the customer journey paradigm. Traditionally, retailers and customers interacted primarily at the point of purchase. With a smart product — think Nest thermostats, Wemo smart switches, Amazon Echoes — that journey changes dramatically, as an episodic event centered around a purchase becomes an ongoing relationship centered around a series of activities.

And that’s a relationship consumers are interested in:

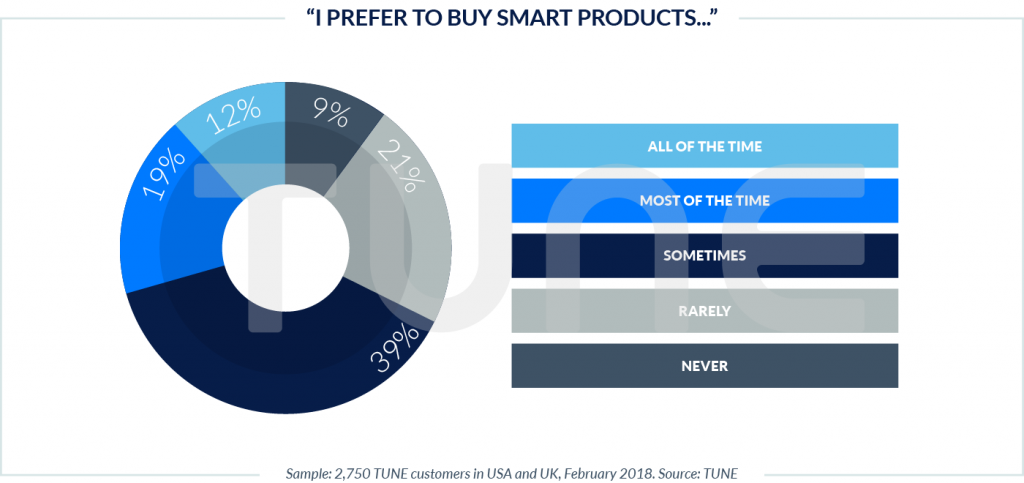

Not only are consumers more interested in staying in touch with brands after buying smart products, 69% of consumers have a significant interest in buying smart products. That’s a real opportunity for brands to have an ongoing relationship with their customers.

Important note: It’s also a major opportunity to demonstrate trustworthiness with private and identifiable data.

What we’re essentially seeing is convergence: Main Street and Silicon Valley are coming together.

More on that next week!

. . .

. . .

To be continued next week: The New Retail: Silicon Valley and Main Street Are Converging.

This is part two of a five-part series on omnichannel customer engagement highlighted in our new e-book, “Taps, Clicks, Bricks: Omnichannel Customer Engagement Is the New Brand Superpower.” Download the full e-book for free here.

Author

Before acting as a mobile economist for TUNE, John built the VB Insight research team at VentureBeat and managed teams creating software for partners like Intel and Disney. In addition, he led technical teams, built social sites and mobile apps, and consulted on mobile, social, and IoT. In 2014, he was named to Folio's top 100 of the media industry's "most innovative entrepreneurs and market shaker-uppers." John lives in British Columbia, Canada with his family, where he coaches baseball and hockey, though not at the same time.

Leave a Reply

You must be logged in to post a comment.