We’re seeing massive change in commerce.

Mobile commerce will hit almost $2 trillion this year. Brand encounters are up to 90% mediated by mobile. And yet desktop is huge, and we’re seeing reverse migration: a convergence of Silicon Valley and Main Street … new bricks-and-mortar commerce startups from both new and established tech companies.

How’s a brand to react?

We asked seven major companies for their insights: Citi, Home Depot, Walmart, OceanX, Unilever, ACI Worldwide, and eBay.

This is part four of a five-part series on omnichannel customer engagement highlighted in our new e-book, “Taps, Clicks, Bricks: Omnichannel Customer Engagement Is the New Brand Superpower.” Download the full e-book for free here.

- Buying Is Changing: Hard Data

- Shopping Is Changing: The New Customer Journey

- The New Retail: Silicon Valley and Main Street Are Converging

- Playbooks: How Top Brands and Retailers Are Winning

- Getting Started: 5 Critical Components for Success

The trends around mobile, apps, and m-commerce are fairly clear. At the same time, the data highlights that consumers still prioritize physical location as a core method of seeing, comparing, and purchasing products, as well as getting post-purchase support and service.

But as we’ve seen, relationship trumps all.

The good news is that different brands in varying circumstances have found multiple paths to success. Here are some noteworthy examples that showcase how different strategies have worked.

Citi: Mobile-First Omnichannel, Because Engagement

As George Orwell didn’t quite say, all channels are equal, but some channels are more equal than others.

Citi is a $2 trillion organization with 3,500 employees, and its customers range from seniors who bank in its 4,600 branches to millenials who bank exclusively via app. All channels are important, Citi’s Chief Experience Officer Alice Milligan says, but not equally so.

“We built our solutions to be omnichannel … that said, some are more important,” Milligan explains. “For us I definitely believe mobile is the most important … and in particular mobile app. We’re focused there because of what it enables.”

And what does mobile app enable for Citi?

Simple: invaluable customer engagement. And, as a result, stronger relationships with known, understood clients.

“Consumers that bank via mobile interact with Citi seven days a month on average, and for millennials, it’s about 10 days a month … there’s much higher engagement,” Milligan says. “We had 21% growth among mobile users versus last year … the highest growth among our competitors.”

Citi’s invested in its mobile app, offering features like automated push messaging for credit score changes, and the option to save progress midway through a transaction and return to it later. Other app features include spend analysis, reward redemption, and tracking replacement cards.

The company also offers mobile web functionality and experiences via other channels, and works hard to be omnichannel.

Particularly in banking, though, there’s something undeniable about apps.

“We used to think mobile web and responsive mobile websites would be the future,” says Milligan. “But app is the preferred mobile channel, and we’ve gotten more sophisticated with using the native features of the device.”

That sophistication has helped Citi grow young customers: “About 40% of our mobile app users in the U.S. are millennials,” according to Milligan.

More importantly, this strategy has enabled Citi to know its customers personally and engage with them regularly — strong hedges against competition, and a major foundation of profitability.

Home Depot: Web + App + Store = Signed-In Omnichannel

With 2,300 locations and almost 400,000 employees, Home Depot is big — just like the products they sell. Large items make online ordering and delivery challenging, and have provided a moat against e-commerce giant Amazon and others.

But it’s an integrated strategy across web, app, and store that has been the true driver of the company’s recent growth.

“Customers move seamlessly between our stores, online, and mobile,” says VP of Online for Home Depot Pratt Vemana. “They’re using mobile within the store, and texting aisle location from their desktops to their phones.”

Interestingly, about 15% of Home Depot’s mobile app usage occurs within the company’s physical locations.

It may seem redundant to use the Home Depot app inside a Home Depot store, but there is method to the madness, Vemana says. Customers who do are accomplishing multiple tasks on the app, not the least of which is checking their Home Depot shopping lists.

“They are wayfinding, quickly finding the product they want,” Vemana says. But it goes deeper than that: “You’re … looking at a product and you want details and reviews … so people go to the product detail page in the app and interact with product reviews.”

While the app is important, Home Depot remains aggressively omnichannel.

A single digital Home Depot experience exists across all channels, Vemana says; signed-in customers can see their shopping lists, saved items, pending orders, and other details across desktop web, mobile web, and app.

Of course, that’s the key: signed-in customers. Only when customers sign in can Home Depot provide the experience and resources that customers want. And only when customers sign in can Home Depot get the customer data it needs.

And yes, mobile web matters.

“Mobile web is being there for the customer no matter whether they shop with us or not,” says Vemana. “It’s being visible, being available [and enabling people] to purchase, browse, get to our store.”

That said, mobile app is for high-value customers.

“Mobile app is truly the customers who have given us the option to be on their home page,” says Vemana. “It’s more premium: we have earned their respect and are valued enough to be on their mobile phone, and the value of customers tends to higher, with a high order value … everything about that customer is valuable.”

Desktop web matters, too.

Shopping for major home appliances is a big deal, and consumers want to see and compare multiple models when making a decision. That takes screen real estate, which desktop web delivers. From there, Home Depot makes it easy to take the purchase process in-store by also showing what models are in stock at the local outlet, and by texting the product location to customers’ phones.

For Home Depot, the “end-to-end” customer journey is critical: discovery and purchase, sure, but also delivery, ownership, use, and service.

“The entire journey is important to us, from early shopping behavior to actual purchase to getting delivery,” Vemana says. “No matter where they want to shop.”

That includes returns and exchanges, which generally happen in-store after an online purchase.

“The whole experience … we make sure that it’s not differentiated in terms of how you bought the product,” Vemana says. “You get the same service however and wherever you bought it.”

Walmart: Store Assistant to Shopping Lists to … Home Delivery?

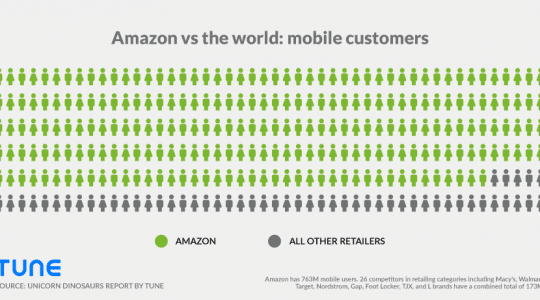

Walmart is a retail giant with 2.3 million employees and a strong desire to take on upstart online competitor Amazon. Recent acquisitions have bolstered both the company’s overall technical capabilities and its mobile chops, and the results have recently become apparent.

Similar to Home Depot, Walmart’s app now automatically shifts to Store Assistant mode when opened within a Walmart location, which can be 200,000 square feet or more in size.

Store Assistant gives customers new capabilities, such as locating a product (down to the aisle and shelf) on a detailed store map.

Walmart is also making its in-app shopping list smart, with services that calculate the total cart cost and real-time item stock availability at a given location.

Add it all up, and you get two major wins for Walmart’s mobile strategy.

First, if customers use the Walmart app more frequently and in-store, they become more likely to use Walmart Pay. Think Starbucks, the preeminent example of a brand and retailer achieving huge wins in customer loyalty, purchase frequency, and deep customer knowledge thanks to a mobile payments strategy. Walmart is hoping to see the same benefits.

(Plus it’s cheaper than running a loyalty program with the same potential results.)

Second, if customers use Walmart’s app to shop (building in-app shopping lists) and pay (Walmart Pay), they’re just one short step away from ordering online and having their shopping list delivered. In both scenarios, Walmart is incentivizing known customers in two ways: convenience, and lower prices.

As app use grows, it’s easy to imagine Walmart stores as the see it/try it distribution centers Amazon is now acquiring, and it’s plausible that a significant percentage of its business could transition to a delivery model — or run on a subscription basis. That makes a lot of sense for its grocery business especially, which accounts for 56% of Walmart’s sales. Grocery customers who purchase digitally are more profitable customers for the retail giant … and the key thing about groceries is that you need them every week.

Walmart may have stumbled in its most recent quarter, leaving Wall Street unhappy with “only” 23% quarter-over-quarter digital commerce growth, but the company’s long-term strategy is still sound.

And that long-term strategy is predicated on known customers.

OceanX: Customization = Relationship = Profitability

While you may not know the name OceanX, you’ve more than likely ordered a product or subscription from one of their clients.

OceanX runs weekly and monthly product subscriptions for 30 top global brands, including retailers and CPG companies. All told, the company’s 60 engineers and 40 data scientists generate over a billion dollars in annual revenue through product subscription services — think along the lines of Dollar Shave Club, Proactiv, and Birchbox — for their clients.

Interestingly, almost all of that billion dollars in revenue is done via mobile web.

“Our world is all mobile,” OceanX CEO Georg Richter says. “Today at least 85% of our orders come in via mobile web … there are no native apps, just web apps.”

Product subscriptions are a unique and recent niche in commerce that bridge the world of physical products with the economics of software-as-a-service business models. Add in a direct, one-to-one relationship with a brand’s end customer, and the result is both lucrative and predictable — enough so that a young upstart named Dollar Shave Club sold for $1 billion to a major brand.

And this niche has unique characteristics.

“Customization is the most important way you understand how happy people are,” Richter says. “The more they customize, the longer they stick.”

When spinning up a new brand, retailers usually advertise on Snapchat, Pinterest, and Facebook before finding the one or two channels that work best. They spend about 30% of revenue in acquiring new business, signing up customers on a website, and putting them on a regular email distribution. Buyers customize their products on the site, and receive boxes of new product on a regular basis, usually monthly.

It’s all about the relationship between the brand and the customer, and the oil that greases that wheel is data.

“We’re into relationship marketing,” says Richter. “You learn a lot about their [customers’] likes and needs, and that helps you upsell or cross-sell also.”

That data helps brands be more human, Richter believes.

“In the end it’s all about storytelling. With technology, the human connectivity is going away … but we do this with heart and passion.”

Unilever: Research Online and Purchase Anywhere (But Mobile First)

The British-Dutch conglomerate Unilever owns more than 400 brands, employs 170,000 people, and has annual revenues of over 50 billion euros. Dove, Lipton, and Ben & Jerry’s are just a few of the brands that the company says over 2.5 billion people use every day.

“Mobile is now the first touchstone,” says Unilever’s Global e-Commerce Experience Design Director Ollie Bradley. “We actually need to start with mobile rather than start with desktop.”

Desktop commerce still accounts for more business than mobile commerce in the U.S., but that’s not the case globally. And the U.S. is at the tipping point where m-commerce will soon surpass e-commerce, according to Bradley.

To prepare, Unilever has developed a game plan and set of standards for communications, images, and brands that prioritizes mobile. And also, of course, enable commerce anywhere: on a phone, on a desktop, in a store, via voice, on a social platform, or anywhere else a consumer wishes.

“Research online, purchase anywhere,” says Bradley.

In essence, this is an omnichannel strategy, as Unilever’s focus is to deliver a great customer experience anywhere — no matter the device, and no matter the screen size.

The next step, however, is one-to-one relationships with customers.

ACI Worldwide: Processing $14 Trillion Every Day, In Every Way

If you’ve never heard of ACI Worldwide, you’re a member of a very popular club. Yet this back-end company processes a staggering $14 trillion for more than 5,100 of the world’s largest retailers and banks every single day.

Unsurprisingly, processing $14 trillion in commerce and securities daily tells you a bit about e-commerce, m-commerce, and just about every other kind of commerce there is.

The primary message?

Brands need consistent presentation and capability across channels.

“Our clients are coming to us more and more looking for unified offerings that bring their payments ecosystem together,” says Mark Ranta, ACI’s Head of Digital Banking Solutions. “In terms of e-commerce and m-commerce payments specifically, you can’t have a separate approach for one channel over another … the payment options have to be consistent regardless.”

At home, at work, and out with friends, you might show different aspects of your personality, but you’re still the same person. The same is true for brands.

And it’s not just about digital commerce.

It’s about all commerce, in all channels.

“We have seen a trend of more e-commerce-first merchants (like Amazon and Warby Parker) move to brick and mortar,” Ranta says. “Obviously the opposite is true too, as some of the more iconic brick-and-mortar brands have tried to move to an m-commerce and e-commerce-first approach (like Walmart).”

Mobile is still critical in an omnichannel environment due to its ubiquity and (as we saw earlier) the preponderance of time people spend on their mobile devices. This means it’s key for brands to offer a mobile-optimized experience, says Ranta.

But mobile isn’t just about the last mile of payments.

“The mobile device can play more into the experience than just the payment,” says Ranta. “Moving that into the experience earlier in the customer journey (in the store looking at items, or ordering your coffee before getting to the store for pickup) can help with both conversion rates as well as moving the client to the payment method of choice for least cost routing for the merchant (a win win!)”

eBay: Mobile First, But Mobile Is Multi-Channel

Nearly 400 million people use eBay, spending close to $90 billion a year via the web’s original auction site. That’s huge volume, and it’s accompanied by huge diversity in channels — even though most of them are mobile.

It starts with apps. eBay’s mobile app is critically important thanks to innovations the company has made that make both buying and selling simple.

“We give customers the opportunity to find and purchase an item that they see in a photo,” says James Meeks, Head of Mobile at eBay. “Image Search allows shoppers to take a photo on their mobile device and then eBay will quickly search for and surface items that are the same or similar for purchase.”

But there are also integrations and other channels.

Mobile web has its place, as the company’s “Find It On eBay” feature enables Pinterest, among other shopping destinations, to point potential buyers to goods on the site. Voice-first interactions with AI assistants are available: eBay customers can ask Google Assistant to find products or check the value of an item they want to sell. And eBay didn’t forget messaging platforms: Facebook Messenger users can chat with ShopBot to find the best deals from over 1 billion listings, Meeks says.

eBay doesn’t operate a physical store. But the company is working on technology that it thinks can appease the desire that a majority of consumers have to physically interact with a product: augmented reality.

“AR technology can bring to life many of the benefits that still drive shoppers to the store, such as trying on clothes, getting inside a car, or seeing home furniture at scale,” Meeks says. “In the past, many customers considered these things to be barriers before they were comfortable with completing their purchase, but with AR technology, customers can interact with the products online through computer-generated content. Ultimately, AR should engage e-shoppers and encourage more browsing and inspirational buying online.”

Omnichannel is important to eBay, but most important is an integrated, logged-in experience.

“We are focused on making a more personalized, seamless online shopping experience across multiple screens, giving our customers the freedom to shop online anywhere, when they want and how they want,” says Meeks.

This makes good sense, given that 61% of eBay’s $90 billion gross merchandise value involves at least one mobile touchpoint.

It also makes sense because web is still important. For eBay, commerce happens quicker on desktop web than on mobile app.

“Across our smartphone shoppers we know that mobile buyers have an average purchase cycle of 28 days, or 10 sessions, versus our desktop buyers who spend only 20 days, or five sessions,” says Meeks. “We are committed to continuing to iterate on our mobile experience to create the best possible customer experience on every platform.”

The end result is mobile-first, but via multiple mobile-mediated channels, and (of course) known, signed-in experiences in each of them.

Different Brands, Different Solutions

Each brand is pursuing slightly different goals, and using slightly different strategies. But there are some commonalities.

Next week, we’ll explore the five key lessons from these brands — and the research that we’ve completed. The goal: aligning your resources to position yourself for success.

. . .

. . .

To be concluded next week: Getting Started: 5 Critical Components for Success.

This is part four of a five-part series on omnichannel customer engagement highlighted in our new e-book, “Taps, Clicks, Bricks: Omnichannel Customer Engagement Is the New Brand Superpower.” Download the full e-book for free here.

Author

Before acting as a mobile economist for TUNE, John built the VB Insight research team at VentureBeat and managed teams creating software for partners like Intel and Disney. In addition, he led technical teams, built social sites and mobile apps, and consulted on mobile, social, and IoT. In 2014, he was named to Folio's top 100 of the media industry's "most innovative entrepreneurs and market shaker-uppers." John lives in British Columbia, Canada with his family, where he coaches baseball and hockey, though not at the same time.

Leave a Reply

You must be logged in to post a comment.